Shares in a company give the owner various shareholder rights. These rights will usually be defined in:

- The company’s articles of association

- Company resolutions; and

- Any shareholder agreements

The prescribed particulars are a summary of these rights. They might be very different between different companies.

Most companies will have a single share class. However, some companies may identify good reasons to operate multiple share classes. In that case, the prescribed particulars may differ between share classes in the company. One class of shares might hold very extensive rights offering a great degree of power and protection to shareholders in that class. These rights would be described in the prescribed particulars for that class. Another set of prescribed particulars, describing the rights of another share class, could be much more narrow and limited.

Manage company shares the easy way

Inform Direct is the perfect tool to help make managing company shares a whole lot easier:

> Transfers, allotments and capital reorganisation

> Step by step processes for all transactions

> Produce attractive share certificates

> Create board minutes and other documents

> Automatic updates to company registers

You might think of the prescribed particulars attached to shares as similar to the set of particulars that an estate agent draws up when they prepare to sell a house. They will describe the various rooms and their sizes, whether there is a garage and what sort of garden there is. In a similar way, to help the purchaser know what they’re getting the prescribed particulars attached to shares will describe:

- Voting rights (if any) that apply to the shares – including whether voting rights arise only in certain circumstances

- Rights to dividends or distributions attached to the shares (if any) – again, it’s possible that these rights will only arise if certain conditions are met

- Any right to participate in a return of capital, including on winding up of the company

- Whether the shares will be redeemed or may be redeemed at the option of the company or the shareholder – any terms or conditions relating to redemption of these shares will also be described.

Is there any template prescribed particulars wording available?

Ultimately, the wording of the prescribed particulars must reflect how shareholder rights are described in detail in the company’s articles of association. The more complex or unusual the shares and rights attached to them, the further you’ll need to steer from any template available.

The two sets of example prescribed particulars we’ve provided below should provide a good starting point. Make sure that you tailor them to your needs:

Prescribed particulars example 1

All shares issued are non-redeemable and rank equally in terms of each of:

1. Rights to take part in all approved dividend distributions

2. Voting rights – each share being entitled to one vote

3. Rights to participate in any distribution of capital on winding up of the company.

Prescribed particulars example 2

Each share is entitled to one vote in any circumstances. Each share is entitled pari passu to dividend payments or any other distribution. Each share is entitled pari passu to participate in a distribution arising from a winding up of the company.

These templates will be most useful for a private company limited by shares using the Model Articles. For other types of company, those using bespoke articles of association or if you’re at all unsure about what needs to be included in your prescribed particulars, you should consider taking professional legal advice.

Why might my company’s prescribed particulars be rejected?

There are a number of occasions when the prescribed particulars must be sent as part of a submission to Companies House. However, they won’t check that the prescribed particulars you submit match up to the rights described in the company’s articles of association. A company should still take care to ensure they’re consistent – otherwise, you may receive queries or complaints from people who rely on this information.

Companies House will, however, reject some prescribed particulars. This would be if:

- The prescribed particulars are left blank or where full information is not provided; or

- Where the prescribed particulars point to another document for information.

Some specific examples of wording in prescribed particulars which Companies House will reject are:

- ‘Not applicable’

- ‘Rights as set out in the Articles’

- ‘Please see the Articles of Association for the Rights’

- ‘Share rights are the same as those already in issue’

When do I have to file prescribed particulars with Companies House?

The situations when the prescribed particulars must be submitted to Companies House as part of a statement of capital include:

- On the formation of a new company

- On the creation of a new share class or a variation of the rights of a share class

- An allotment of shares

- When the company’s share capital is reduced

- When shares are consolidated or sub-divided

- When an unlimited company is converted to a limited company

- When redeemable shares are redeemed

- If shares are cancelled after the company purchases its own shares

- If share capital if re-denominated

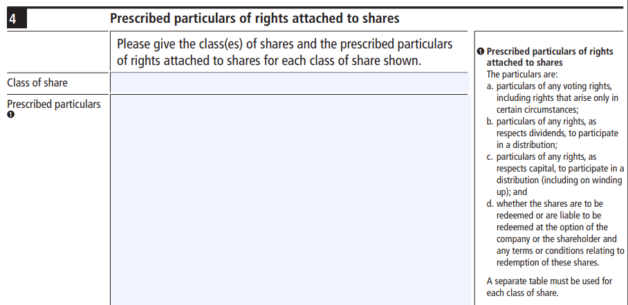

On a paper form, the prescribed particulars will need to be entered in a box like the example below, which is from the SH09 form. The particulars for each share class must be entered separately.

Prescribed particulars, specifically those relating to voting rights, must also be included for each class of share in a confirmation statement, where changes have not otherwise been reported to Companies House.

Companies House hold the last submitted prescribed particulars for a company. The company can retrieve and view this and other information. You can easily do so using Inform Direct’s company secretarial software.

Inform Direct is the innovative and easy way to manage a company's shares, make new share allotments, record share transfers, produce share certificates and much more.

A previous version of this article was originally published on 14 May 2014.