This article explains the rules and conditions for paying dividends to shareholders of small and micro-entity companies. What needs to be in place before a company can declare and pay a dividend to its shareholders? What factors influence the decision? When should the directors refrain from declaring a dividend?

This guide applies to small and micro-entity limited companies. Larger public and listed companies have their own set of requirements and procedures for dividends. These are usually dealt with by professional company secretaries.

What are the conditions for paying out a dividend?

A private company limited by shares can pay dividends when it is financially stable and has sufficient profits. Dividends must be paid out of net profits from its profit and loss account, never out of its capital.

Work smart, not hard issuing dividends

> Shareholder resolutions

> Board minutes

> Dividend vouchers

All at the click of a button.

A company may only make a distribution out of profits available for the purpose. – Companies Act 2006, section 830

A company can pay dividends to its shareholders when the following conditions are met:

- The articles of association allow for the payment of dividends (the model articles do, but custom articles may not).

- The company has made sufficient profits. Dividends can only be paid from the company’s profits after deducting all expenses and tax liabilities. After payment of the dividend, it is preferable for there to be sufficient retained earnings (see below) to plough back into the company for healthy growth.

- The directors of the company have resolved to pay dividends. The decision to pay dividends must be made by the directors and recorded in the company’s minutes. Final dividends require shareholder approval; interim dividends do not.

- The company has sufficient funds to pay the dividends. Before paying dividends, the company must have enough cash or liquid assets to cover the payments, and the directors must judge that the payment will not cause cash flow problems.

After payment of the dividend, it is preferable for there to be sufficient retained earnings to plough back into the company for healthy growth.

What are retained earnings?

Retained earnings refer to the portion of a company’s profits that are not distributed as dividends to shareholders but instead are kept by the company to be reinvested in the business or used to pay off debt. Retained earnings represent the cumulative profits that a company has earned over time, minus any dividends paid out to shareholders.

Retained earnings typically appear as a line item on a company’s balance sheet under ‘shareholder equity’. Dividends are paid out of retained earnings. Before paying a dividend, it should be ensured that it will leave enough retained earnings behind to invest in new growth opportunities and pay off debts and liabilities.

Any dividend payment made in breach of the rules can lead to HMRC penalties and in some cases a director can find herself personally liable for the amount of the illegal dividend. Any shareholder who received an unlawful dividend payment may have to repay it if they knew the facts that made it unlawful, whether or not they understood that those facts made it unlawful.

These rules can become especially pertinent where a shareholder is also a director. For tax efficiency, company directors often pay themselves a mixture of cash and dividends. This creates a potential conflict of interest, particularly with interim dividends that don’t require shareholder approval and when one or more directors hold types of share such as preference shares. It is possible to arrange things so that directors receive dividends and ordinary shareholders don’t, or receive less per share.

Transparency and proper documenting of all dividend payments are key to a well-governed company. HMRC is likely to take an interest in how company directors pay themselves, so it is a good idea to obtain proper advice on this to ensure compliance.

Any shareholder who received an unlawful dividend payment may have to repay it if they knew the facts that made it unlawful, whether or not they understood that those facts made it unlawful.

Does a company have to pay dividends if it has sufficient profits?

A company is not obliged to pay a dividend just because it has sufficient cash reserves. Shareholders do not have a ‘right’ to receive dividends. Even if funds are available the board may choose to withhold the dividend if payment would leave it struggling to service debts. The company may be solvent before a dividend is paid out, but if it would struggle afterwards then it may be best to seek professional advice. Ultimately it is a directorial decision, bearing in mind that it is a company director’s duty to protect the company’s interests.

There is no set schedule for dividend payments. They are entirely at the discretion of the board of directors. It is common to make a decision on dividends quarterly or every six months. But there is no legal requirement either to issue dividends or to issue them with regularity or following any particular calendar dates.

Final vs. Interim dividend

A company can declare two types of dividend:

Final dividend

The final dividend is any dividend paid out after its annual accounts are finalised. The directors make a recommendation to pay a dividend and this goes to shareholder approval via an ordinary resolution. Shareholders cannot increase the amount of dividend decided upon by the directors. Private companies don’t have to vote on dividends at an AGM. They can hold a general meeting, wait till the AGM to approve a final dividend distribution, or have a written resolution of members.

Interim dividend

An interim dividend is paid before the annual accounts have been finalised. The exact timing of an interim dividend can vary from company to company, but it is usually paid when the company’s management feels confident about its financial performance and wants to distribute some of its profits to shareholders. Some companies may choose to pay interim dividends on a regular basis (e.g. every quarter), while others may only pay them occasionally as needed. Shareholder approval is not required for interim dividends unless the company’s articles of association say otherwise.

It should be understood that a dividend declaration is a commitment to the shareholders to pay out a dividend. There can be legal consequences if it is reneged upon. The directors’ judgement and integrity are at stake when declaring dividends, so such decisions must be based on sound financial foundations.

How is a decision to pay a dividend reached?

The directors’ decision to pay a dividend should be based on the company’s financial performance and future prospects. They must ensure that the company has sufficient reserves to meet its obligations and that paying dividends will not negatively impact its financial stability.

The directors should analyse the company’s accounts. On the balance sheet, there needs to be a healthy figure under ‘retained earnings’ or ‘profit and loss reserves’. For micro-entities, funds available to pay dividends are found under ‘capital and reserves’.

The profits shown here must be ‘realised profits’ for which cash has been received, not ‘paper profits’ which will mature at a later date. The bare figures may not distinguish between these, so care should be taken to make sure the company actually holds the cash to make a dividend distribution.

Where time has elapsed since the annual accounts were finalised, directors should allow for any fluctuations in the company’s balance sheet in the meantime. If the financial position has deteriorated since the accounts were last filed then it may be that there are no longer sufficient reserves to pay out a dividend. Conversely, if the financial position has improved then the directors may decide to pay out a greater dividend. Where there have been changes in the company’s fortunes that may affect its ability to pay out a dividend or the amount to pay out, it is best to prepare a new set off accounts (interim accounts) as evidence to support the directors’ decision.

The profits shown here must be ‘realised profits’ for which cash has been received, not ‘paper profits’ which will mature at a later date. The bare figures may not distinguish between these, so care should be taken to make sure the company actually holds the cash to make a dividend distribution.

Groups of companies

In a group of companies, the fortunes of each subsidiary company are separate from those of the group as a whole. Even if the group’s profits are high, as a separate company a subsidiary cannot pay a dividend to its investors if it lacks sufficient cash reserves. It is prudent to seek professional guidance before moving assets around within a group of companies to facilitate a dividend pay-out.

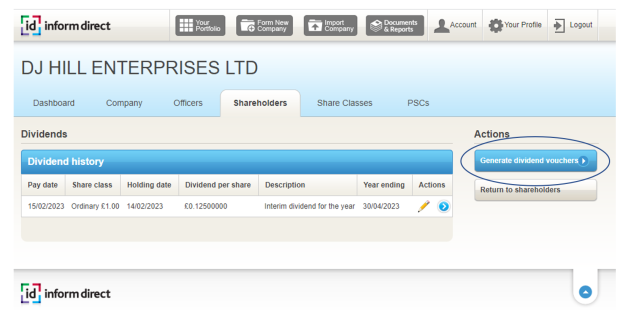

Inform Direct calculates the dividend for each shareholder and produces beautiful dividend vouchers for you to send to them.