During the life of a company many important decisions must be passed via resolutions under the Companies Act 2006. An ordinary resolution is the most common of these as rarer and fewer decisions require a special resolution.

Most companies pass at least one of these each year. This is done by achieving just a ‘simple majority’ – more than 50% of votes cast – of members voting ‘for’ it (members are the shareholders in a company limited by shares).

In this article we will cover:

- What an ordinary resolution is

- The company decisions requiring ordinary resolutions

- How an ordinary resolution is passed

- The ordinary resolutions that require special notice

- Any additional requirements for ‘listed’ companies

Need document templates?

Inform Direct produces populated board minutes and written resolutions including the required resolutions, all as part of the process.

What is an ordinary resolution?

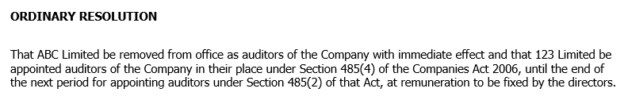

An ordinary resolution is the method by which members approve routine company decisions, traditionally in general meetings. Below is an example of an ordinary resolution for removing and replacing an auditor.

What decisions require an ordinary resolution?

Most company decisions are made by resolution and this will be an ordinary resolution unless the Companies Act 2006 or the company’s articles of association require it to be a different type of resolution. Here are some typical examples of decisions passed via an ordinary resolution:

- Approval of the annual accounts

- Approval of a final or interim dividend

- Re-appointment and appointment of a director

- Increasing the share capital limit

- Reappointment of auditors

- Removing a director

Certain (more important) company decisions are required to be made by a special resolution which require at least 75% of the votes cast to be passed.

A company’s articles of association may require that some specific decisions that may normally require an ordinary resolution instead require a special resolution, therefore it is always prudent to check a company’s articles when planning to conduct such business at a general meeting.

How is an ordinary resolution passed?

An ordinary resolution is passed by what is referred to as a ‘simple majority’ of members, meaning that the votes ‘for’ must equate to more than 50% of the total votes cast by each member’s voting rights.

The resolution is either:

- Voted upon at a general meeting, such as the AGM (following the usual notification rules for holding such a meeting and its contents); or

- Passed by a written resolution.

Note that there are two ordinary resolutions that cannot be passed by a written resolution:

- Removal of a director before the end of their planned term

- Removal of an auditor before the end of their planned term

As you will see in most general meetings (at least for small, non-public companies) an actual calculation is not required. A simple show of hands often provides enough to show which way the simple majority lies.

Example

As part of a board meeting, the board of directors decided to propose the appointment of a new director. It was decided that this would be proposed as an ordinary resolution at the upcoming annual general meeting (AGM).

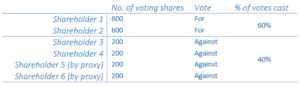

At the meeting, voting commenced on the proposed ordinary resolution to appoint the new director. The company has 2,400 shares with equal voting rights, which are split between 8 shareholders in varying proportions. Only 4 shareholders were present at the meeting and voting. Two other shareholders cast votes by proxy. The result of the vote was as follows:

As the votes ‘for’ the ordinary resolution were greater than 50%, the resolution passed. This was recorded in the minutes of the meeting.

If the 2 shareholders that didn’t take part had voted against the appointment, the votes ‘for’ would have totalled 50% and hence the resolution would not have passed as this is not greater than 50%.

Which resolutions must be filed with Companies House?

While all special resolutions must be filed with the registrar of companies, comparatively few ordinary resolutions need to be filed with them. Two ordinary resolutions which do need to be filed at Companies House are:

- Re-denomination of shares to another currency

- Agreeing that a company may send or supply documents or information to members by making them available on a website

When one of these ordinary resolutions is passed a copy of the resolution must be sent to Companies House within 15 days. Since 2021 Companies House allow these to be uploaded online.

Which ordinary resolutions require ‘special notice’?

Certain company decisions that can be passed via an ordinary resolution require special notice to be provided to all shareholders at least 28 days prior to the ordinary resolution being voted upon. In fact, the Companies Act 2006 states that the company must “…where practicable, give its members notice of any such resolution in the same manner and at the same time as it gives notice of the meeting”.

The decisions that require such special notices are:

- Removing a director before the director’s period of office is due to end

- Appointing an auditor who is not the retiring auditor

- Removing an auditor before their retirement from office date

- Filling a casual vacancy in the office of auditor

- Reappointing the retiring auditor who was appointed by the directors to fill a casual vacancy

Are there additional requirements for ‘listed’ companies?

Companies that have their shares listed for trading on a market must provide two copies of all resolutions passed to the FCA’s ‘primary market functions’ department immediately (previously referred to as the UKLA), who will make them available for public inspection.

Where performing company secretarial duties for a ‘listed’ PLC we’d recommend that you seek advice from an expert in such companies.

This article was originally published in January 2013 and has been completely revised and updated. It was republished in May 2022.

If you say the voting is happening with show of hands then why are the voting percentage rights taken into consideration?

Good question – When voting with a show of hands, each hand is still representing their shareholding, not just one vote.

In practice a show of hands is still enough to see where the majority lies without any detailed share counting, if:

– There is a majority shareholder

– There are only a few shareholders and most or all vote the same way

– There are only a few shareholders and the chairperson has a enough of an idea of each person’s shareholding to be able to determine if a more detailed count is needed (e.g. they see that the 3 main shareholders all voted the same way).

As most companies on the UK register have only a handful of shareholders, most votes will fall into one of the three cases above and they will generally use the ‘show of hands’ voting approach.