Companies will do a share split, whereby each share is subdivided into two or more shares. This means that each shareholder will have more shares but each share will have a lower nominal value.

Commonly, each existing share is split into 10, 100 or 1,000 new shares as part of a share split but it may be that each 5 shares are split into 7 new shares. In this article we:

- explain what a share split is;

- why a company might choose to split its shares;

- the steps it would take to process the split;

- provide an example of the entries to enter into the form SH02; and

- provide a template resolution you can adapt and use to approve a share split for your own company’s shares.

What is a share split?

A share split or share subdivision is where the shares in an existing share class are each subdivided into two or more new shares. A straightforward split will not change the shareholders’ rights, meaning that following the split the voting control and rights to dividends will be unchanged. It just changes the number of shares and the nominal value of each share.

Share split example

A company has 100 ordinary £1 shares and is valued at £100,000, giving each share a value of £1,000. This may be seen as too high a price per share for new investors. The company therefore completes a 1 for 100 split which increases the number of shares to 10,000 and reduces the nominal value to 1p and the share price to £10 per share.

The old £1 shares will cease to exist and the only shares in issue will be the new ordinary 1p shares. The rights attached to each new 1p share will be the same as the rights attached to the old £1 shares. If you had 10 shares and thus 10% of the equity before the split you will have 1,000 shares and still only 10% of the equity after the split.

Share splits are often a straight 2 new shares for every old share (2 for 1), 10 for 1 or 100 for 1 but can be 5 new shares for every 3 shares or even split the share class into two different share classes – so, as an example, for every ordinary £1 share held each shareholder gets one ordinary 10p share and nine deferred 10p shares. The legal requirements for this is that each £1 ordinary share is split into ten ordinary 10p shares and then nine tenths of the ordinary shares are converted to deferred 10p shares.

In the 5 for 3 situation shareholders may not have a holding that is exactly divisible by 3. This and other similar situations would result in remainder shares in the share class being split. These remainder shares then need to be dealt with.

Share split example with remainder shares

A company chooses to make a 5 for 3 share split.

Angus, who has 15 shares before the split, receives 25 new shares.

Before the split, Beatrice had 11 shares. In exchange for 9 of the original shares, she receives 15 new shares. However, that leaves two of the old shares to deal with, because it’s not possible to issue a fraction of a share.

In this case, the company will often cancel the remainder shares, in some case making a payment to the shareholder in respect of them.

Why split the company’s shares

The main reason for doing a share split is to improve the liquidity in the company’s shares.

For instance, an owner of just 1 ordinary share with nominal value of £1 cannot sell half a share but if there were 100 ordinary shares with nominal value of 1p each the owner could choose to sell 50 shares. Equally, a new investor may be reluctant to invest £1,000 and only receive 1 share whereas they would be more comfortable receiving 1,000 shares with a lower nominal value of £1 per share, albeit for exactly the same percentage interest in the company.

Share splits are frequently done by publicly quoted companies as it reduces the share price in line with the split but does not reduce the overall market value of the company. In fact, it can lead the overall market value to increase as it makes the shares more affordable to individual investors and hence can increase the demand for them.

How to do a share split in 7 easy steps

Once a company has decided to split its shares, it’s quite straightforward to do.

Here we set out the simple steps for a company that only has one fully paid share class when splitting 100 ordinary £1 shares into 10,000 ordinary 1p shares. If you are at all unsure about any of the steps or the consequences then you should take professional advice from an accountant, solicitor or other professional.

We start with some preliminary considerations that must always be considered before performing a subdivision of shares:

1 Do the articles of association allow a share split?

There is, following the enactment of the Companies Act 2006, no longer a requirement for the company’s articles of association to permit the subdivision of shares. However, you will need to check that the Articles do not actively restrict or exclude the right to split the company’s shares. If the company was formed with the model articles then, provided they have not been amended, you will have the right to split or subdivide your shares.

If the company’s articles of association do not allow a subdivision then to proceed these would need to be amended. See our article on amending articles of association.

2 Is there a shareholders’ agreement in place?

Although the subdivision will leave each shareholder with the same percentage interest after the split as before, it is worth checking if there is a shareholders’ agreement and whether there are special provisions that need to be observed – for example, the company may need to give special notice before continuing with the subdivision.

3 Ensure the proposed subdivision of shares is appropriate

It is all very well creating millions of new shares but the benefit of increased liquidity could be undone if the number of shares would become unwieldy. It’s worth considering whether there are options other than a split to achieve the same aim.

Assuming the above do not raise any issues then the company can continue with splitting the shares.

4 Pass a shareholders’ resolution approving the split

Provided the articles allow a split, it is sufficient that this is an ordinary resolution. We’ve created a free template resolution to split shares that you can adapt and use. Given there are likely only to be a few shareholders it may be as well to pass this as a written resolution, although a resolution passed at a meeting of shareholders is equally acceptable. This resolution does not need to be sent to Companies House but should be kept with the company records.

5 File form SH02 at Companies House

At the moment the SH02 form needs to be submitted either using the Companies House document upload process or on paper. You will need to complete sections 1, 2, 4, 7 and 10 and sign at section 11. When using Inform Direct the relevant sections are completed for you leaving you to just sign the form before sending it to Companies House. Once completed and signed, the form can currently be uploaded to Companies House using their document upload service.

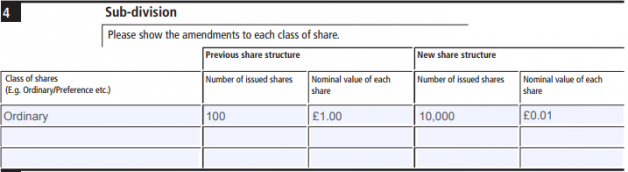

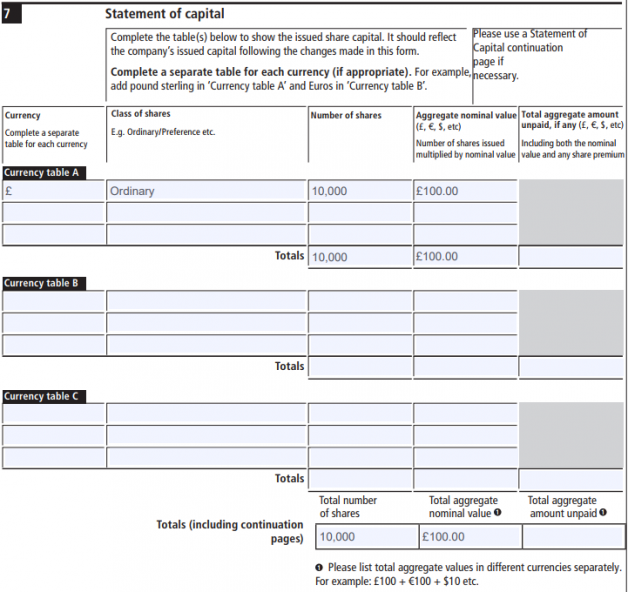

These examples of sections 4 and 7 show 100 shares of £1.00 nominal value being split into 10,000 shares of £0.01.

The prescribed particulars required in section 10 will be the same particulars as those of the old £1 shares. In another article, we’ve looked at what needs to be included in the prescribed particulars for a share class.

6 Update the register of shareholders

The register of shareholders (also referred to as the register of members) will need to be amended to show the number of shares held in the new nominal value by each shareholder.

7 Issue new share certificates

Sometimes the old share certificates may be called in for amendment but it is more common to send members a notice that the share split has taken place and enclosing a new share certificate. Increasingly, a new certificate is what shareholders will expect to receive.

Inform Direct makes a share split easy. It does the calculations and produces the required Companies House form and more.

Previous versions of this article were published on 10 August 2015 and 12 June 2018 (updated for the revised form SH02) with the latest version updated to cover Companies House’s document upload process.

Is this article relevant for a public company?

Yes the article should be relevant for a public limited company.

Hello, could I use SH02 to do share split and increasing share capital at the same time?

You can only use the form SH02 to inform Companies House of share splits, consolidations and redemptions. You can use Inform Direct to generate the necessary paper form SH02 for this. If you need to inform Companies House of an increase in share capital you need to use the form SH01, which if you use Inform Direct to process the share allotment will send the form SH01 electronically so that you do not need to complete a paper form.

Ah, so I would need to submit both SH02 and SH01 separately?

Yes as you state you should submit both forms.

Trying to change 300 £1 shares into 100 “A” £1, 100 “B” £1 and 100 “C” £1 shares. The company has the model articles of association. What submissions need to be made to Companies House?

Andy what you are trying to achieve is not really a share split but three share conversions to concert 100 of the existing shares in ‘A’ shares, 100 of the existing shares into ‘B’ shares and 100 of the existing shares into ‘C’ shares. The submissions to Companies House will then be forms SH08 (Notice of name of other designation of class of shares) and SH10 (Give notice of particulars of variation of rights attached to shares). Share conversions can be processed using Inform Direct’s software. To complete the conversions it is likely that you will need to change the company’s articles of association to allow the conversions. Whether or not the articles of association need to be changed it is also likely that a suitable shareholder resolution will also need to be filed at Companies House.

Once SH02 form and Special Resolution has been signed, do you need to file both to companies house or just the SH02 form?

Also, new articles of association have been adopted. Do we need to send these to Companies House also?

Thanks in anticipation

Yes, both the form SH02 and the special resolution approving the share split should be sent to Companies House. Whenever a company’s articles of association are changed a copy should always be sent to Companies House together with a copy of the special resolution approving the new articles.

Hi, currently looking to subdivide 100 x £1 shares in to 7000 shares – this makes the nominal value of each share £0.0142857142857143. Is this permitted and will the form SH02 accommodate such a value?

There is nothing to prevent the company doing the split of 100 £1 shares into 7,000 £0.0142857142857143 shares. On the pdf form SH02 you can enter 16 decimal places if the nominal value is less than 10. However for third party online submissions to Companies House the nominal value can only have six decimal places (a requirement set by Companies House), so the nominal value would need to be rounded to £0.014286 if you make online submissions.

I have company with 2 clazses of shares, A and B, where the B shares are effectively freezer share and take any increased value of the company. Can I split the A shares only using the example given?

A company can, with the approval of its relevant shareholders, split just the A Shares or just the B shares or both share classes unless the articles of association prevents this. You would also need to review any shareholders’ agreement to ensure that this does not prevent such action.