When setting up a company with family or friends it is easy to assume that nothing can go wrong in the future. You might assume that, as you trust one another, you do not need to put in place something like a shareholders’ agreement. You might think that asking for such an agreement will make it sound like you do not trust or respect your new business partner(s).

Hopefully, nothing will go wrong in the future. However, even family members and best friends fall out. If the worst should happen, you could then end up with nothing. Or you might face the breakdown of a friendship alongside a costly and acrimonious legal dispute related to the business.

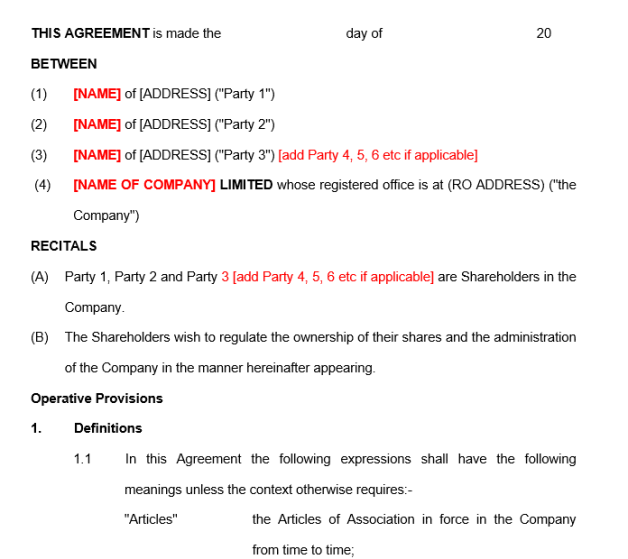

As well as describing here the features of a shareholders’ agreement, we also have a simple shareholders’ agreement template that is available to download.

Hopefully, nothing will go wrong in the future. However, even family members and best friends fall out.

Although the company’s articles of association and company law will help to some extent, a fully considered and well drafted shareholders’ agreement can act as a safeguard and give shareholders more protection against these types of scenario.

Some people with a shareholders’ agreement will never need to rely on it. However, there are many more cases where shareholders wish they had taken the time to put a proper agreement in place.

If you are going into business with others and are looking for confidence about your future relationships with them, consider putting a shareholders’ agreement in place. It can protect both the business enterprise and your own investment in the company.

Manage your company's shares the easy way

Inform Direct allows you to smoothly make share allotments, record share transfers and process share reorganisations.

What is a shareholders’ agreement?

A shareholders’ agreement is, as you might expect, an agreement between the shareholders of a company. It can be between all or, in some cases, only some of the shareholders (like, for instance, the holders of a particular class of share). Its purpose is to protect the shareholders’ investment in the company, to establish a fair relationship between the shareholders and govern how the company is run.

The agreement will:

- set out the shareholders’ rights and obligations;

- regulate the sale of shares in the company;

- describe how the company is going to be run;

- provide an element of protection for minority shareholders and the company; and

- define how important decisions are to be made.

The agreement will contain specific, important and practical rules relating to the company and the relationship between the shareholders. This can be beneficial both to minority and majority shareholders.

How will a shareholders’ agreement help a minority shareholder?

Without a shareholders’ agreement, a minority shareholder (one owning less than 50% of the shares) will generally on their own have little control or say in the running of the company. Indeed the control will often rest with one or two shareholders. Companies are generally run by majority decision. Even if the articles of association include provisions that protect the minority, these can be changed via special resolution by holders of 75% of the voting shares. There are laws that provide limited protection to minority shareholders but these can be costly to enforce and may not achieve the required redress.

Being a minority shareholder and having a shareholders’ agreement that includes the requirement for all shareholders to approve certain decisions ensures that you have a say in the important decisions that impact the company. This could be decisions on:

- the issue of new shares;

- appointment or removal of directors;

- taking on new borrowings; or

- changing the main trade.

However, if all decisions have to be unanimous this could cause problems and ultimately prevent your company carrying out its business.

A minority shareholder may want a provision included that if someone is willing to buy the shares of a majority shareholder, they can only sell the shares if the same offer is made to all shareholders including minority shareholders. This is often referred to as a ‘tag along’ provision. This should then ensure that minority shareholders receive the same return on their investment as the other shareholders.

How will a shareholders’ agreement help a majority shareholder?

If a majority shareholder wants to sell their shares but a minority shareholder is unwilling to sell theirs, then including a provision forcing that shareholder to sell their shares is important. This is often referred to as a ‘drag along’ provision. This will then allow the majority shareholder to realise their investment at a time and price that they feel is appropriate. Obviously, the price and other payments for the sale will need to be fair for all shareholders, including the minority shareholders.

In addition a majority shareholder would want to prevent minority shareholders passing on confidential company information to competitors or setting up rival businesses. Each of these can be included as a provision within the agreement.

Another concern is where a minority shareholder could transfer their shares to anyone. This could cause problems for the other shareholders, especially if the sale is to a competitor or someone else the other shareholders do not want involved with the company. Conversely, however, to force an unhappy shareholder to stay may cause more problems than having a new unknown shareholder who is interested in the company being successful. All the shareholders need to get on with each other for the business to thrive. To overcome these problems, shareholders’ agreements will often include rules around share sales and transfers – who shares can be transferred to, on what terms and at what price.

How will a shareholders’ agreement help where two shareholders each own 50% of the shares?

Where you and your fellow shareholder own 50% each in a company it is important to have a dispute resolution provision included as you may fall out. Without an agreed procedure to resolve disputes no decisions can be made, leaving the company unable to operate.

When should a share agreement be put in place?

Usually it is best to put a shareholders’ agreement in place when there is more than one shareholder, which could be when the company is formed and the first shares are issued or at a later date. In fact, it can be a positive exercise to ensure there is common understanding of shareholders’ expectations of the business. At that point, the shareholders should, as far as is possible, be of a similar mind about what they expect to offer and get from the company. Indeed, if the differences of opinion between the investors at this stage are too strong to form a shareholders’ agreement, it is likely to ring warning bells about the nature of their future working relationship.

Usually it is best to put a shareholders’ agreement in place when the company is formed and the first shares are issued.

The investors may choose to defer discussing a shareholders’ agreement in order to get on with the important task of establishing the business. While they may have every intention of return to it at a later date when there is more time, the appropriate opportunity may not arise and something else always takes priority. Even if they do pick it up later, by then the shareholders’ expectations and feelings towards the business may have diverged. This makes it more difficult for them to agree to the terms that should be included in the shareholders’ agreement.

What should be included in a shareholders’ agreement?

This, as described above, will depend on the number of shareholders and their respective shareholdings. The key provisions, however, that should be considered for inclusion are those relating to:

- Issuing shares and transferring shares – including provisions to prevent unwanted third parties acquiring shares, what happens to shares on the death of a shareholder and how a shareholder can sell shares.

- Including any tag along or drag along provisions.

- Providing some protection to holders of less than 50% of the shares – including requiring certain decisions to be agreed by all shareholders.

- Paying dividends.

- Running the company – including appointing, removing and paying directors, frequency of board meetings, deciding on the company’s business, making large capital outlays, providing management information to shareholders, banking arrangements and financing the company.

- Competition restrictions.

- Dispute resolution procedures.

We look at these and other things you might want to include in our What should be included in a shareholders’ agreement? article.

It is possible that the contents of the shareholders’ agreement may overlap with other company documents, particularly the articles of association. The articles will, for example, contain provisions relating to decision making and transfers of shares. In another article we explore what investors should look for in a company’s articles of association.

Consider seeking legal advice if you are not sure which provisions to include in which documents, but overall do ensure that the shareholders’ agreement and articles of association are consistent with one another.

Inform Direct is the innovative and easy way to manage a company's shares, make new share allotments, record share transfers and more.

This article was originally published in June 2014. The most recent update was in September 2023.

Vary we’ll drafted document. Useful for all the stake holders in the company at time of its incorporation.

It is useful document for all the promoter shareholders in the company irrespective of the fact whether the shareholder is minority or majority shareholder of the proposed company.