When a shareholder dies it can be traumatic for everyone involved with the company. This guide aims to make the administrative side of things less overwhelming. It points the way through the process of dealing with the deceased person’s shares. It also clarifies the status of a deceased PSC during the period before their shares have been transmitted to their new owner.

This guide is intended as a quick reference when dealing with the aftermath of a shareholder’s death. There are two other associated guides that may better suit your circumstances:

- For guidance on planning in advance for this event, see our article Preparing your private company for the death of a shareholder.

- For what to do after the death of a director, see our article What to do if a director dies.

Transfer shares at the touch of a button

Inform Direct is the easy way for companies to manage share transfers.

> Produce pre-populated stock transfer forms

> Create share certificates for shareholders

> Print compliant board minutes

> Automated updates to statutory registers

> Easy confirmation statements

What to do when a shareholder dies?

To correctly administer the shares of a deceased shareholder, three documents need to be considered:

- The will (if any)

- The articles of association

- Any shareholders’ agreement

It should be noted that the above documents may be in conflict and will need to be carefully considered to decide what course of action takes precedence.

The will

The starting point is that the shares will form part of the estate of the deceased. The shares will be administered by the executors (if there is a will) or administrators (if there is no will). The term ‘personal representatives’ (PRs) includes both executors and administrators, so we will use it here.

If there is no valid will, the next of kin will need to apply to HM Courts & Tribunals Service for a grant of letters of administration. This gives them the right to manage the estate of the deceased. The application can be done with or without the supervision of a probate practitioner. Either way it is not a quick process and it can be some time before the company hears from the next of kin.

In the relatively rare instance of there being no known next of kin, the shares may pass to the Treasury Solicitor whose role it is to pass the estate to the Crown. However, the company’s articles of association and any shareholders’ agreements are likely to come into play before this happens.

“When deciding what to do with the shares of someone who has died, the will generally does not outweigh the company constitution or written agreements made within the company.”

Eventually the PRs will approach the company with a grant of probate or letters of administration and do one of the following:

- Execute a stock transfer form transferring the shares to a named beneficiary

- Become custodians of the shares until a buyer is sought. They should apply to the company in writing and the register of members should be updated with their names.

When deciding what to do with the shares of someone who has died, the will generally does not outweigh the company constitution or written agreements made within the company. So, before the PRs can sell or transfer the shares they will need to establish that there is nothing to frustrate this. Such obstacles are most likely to be found in the articles of association.

The articles

The articles of association of a private company often contain restrictions on the transfer of shares. Sometimes, those in charge of the deceased’s estate will not be able to transfer the shares to anyone unless they are first offered to the other existing shareholders. Provisions whereby existing shareholders get a right of first refusal are referred to as ‘pre-emption rights.’

It is quite possible that the PRs will honour the pre-emption rights by offering the deceased’s shares to the existing shareholders but find no takers. This leaves them free to transfer the shares to the beneficiaries of the deceased’s estate. However, the beneficiaries may never be able to sell their shares in a private company.

There may also be a ‘deemed transfer’ provision in the shareholders’ agreement or articles whereby the deceased’s shares are automatically deemed to have been offered up for transfer upon their death. If present, this will have to be respected.

Shareholders’ agreement

Scenarios like the above should be anticipated and can sensibly be addressed with a shareholders’ agreement. This is a private agreement between shareholders that is not required to be filed at Companies House. It is designed to prevent shares falling into the hands of unwanted third parties and regulates, among other things, how shares are transferred in the event of a shareholder’s death. It should be checked to see whether anything in it conflicts with the deceased’s will.

As mentioned above, when there is conflict here it is the articles and/or shareholders’ agreement that take precedence over the will.

If the sums are significant, the shareholders’ agreement may be underpinned with life insurance policies for each member. On a member’s death these will provide funds for the remaining members to buy the deceased’s shares at a price that means the estate receives a fair value for their shares.

There may be other agreements between the deceased and the other shareholders which regulate what happens to his shares if he dies. A common arrangement of this type is a cross-option agreement.

For more on shareholders’ agreements, see our articles What is a shareholders’ agreement? and What should be included in a shareholders’ agreement?

Death of a sole director who is also the sole shareholder

In the case of companies with a sole director who is also the sole shareholder, the death of that individual leaves nobody at the company with legal authority to make decisions or appoint new officers. The company stops in its tracks. Creditors and employees may go unpaid until the situation is resolved.

In companies incorporated after October 2009, model article 17(2) allows the deceased shareholder’s PRs to appoint a director by notice in writing, without first having to become a registered shareholder. But in companies incorporated earlier or with bespoke articles, this provision may not be present. This can lead to deadlock; there is no director or company secretary to update the register of members, and the PRs cannot appoint a director until they have been registered as members. It is rather like being locked out of a car with the keys inside.

In this situation the PRs may find themselves forced to apply for a court order to get themselves registered as members so that they can appoint a director and get things going again.

It is worth being familiar with the added potential complication of a sole director’s powers to run a company having been called in question in the High Court case Hashmi v Lorimer-Wing [2022]. In that article we offer a free solution to this potential issue in the form of amended articles of association.

Death of a PSC

If the deceased shareholder is a PSC, questions can arise over the PSC status of the deceased. If a PSC change is submitted giving ‘The estate of X’ as the PSC, Companies House are likely to reject it since it does not clarify who exactly the new PSC is. Here is the Government’s guidance on how to proceed when a PSC dies:

“In the unfortunate event that a PSC of your company is deceased, the PSC should remain on the PSC register until such time as their interest is formally transferred to its new owner.

While an executor has fiduciary duties to the intended beneficiaries of the assets, the executor is responsible for administering the estate, according to the wishes of the deceased.

The deceased will therefore continue to be registrable until such time as the control passes to another person, such as an heir, who will exercise their influence and control over your company for themselves.”

Death of a member in joint shareholdings

This is straightforward: the surviving shareholders in the joint shareholding retain the shares and the deceased’s name is struck from the register of members. The remaining shareholders all move up one place in the order of names on the register of members.

It may be worth knowing that only one person has the voting rights in a joint shareholding: the one whose name appears first in the register of members. That person, called the ‘senior’ shareholder, may change following a death. The first-named shareholder is also the one to whom communications are to be sent regarding the joint shareholding, and a letter sent to the senior is deemed sent to all the joint shareholders.

A death certificate is needed because joint shareholdings are not treated as part of the deceased’s estate. The death certificate must be validated with the company’s official stamp along with the amended share certificate. These are then returned to the sender.

How to process the transmission of shares

The word ‘transmission’ is used for the automatic transfer of shares when a shareholder is made bankrupt or dies. The shares are transmitted to the PRs or joint shareholders. Upon receiving the shares PRs acquire the same rights the shareholder had, except for voting rights in the company. To acquire voting rights they must apply in writing to have their name(s) added to the register of members.

The first step in processing the transmission of shares upon the death of a shareholder is to check your articles. They may contain provisions for this eventuality. Failing that, the legal position is that after a person dies, the shares form part of their estate and will be passed to the will’s beneficiaries. The shares may form part of a specific legacy or fall into the residue of the estate. Either way, the representatives of the estate need to contact the company to initiate the transmission of shares.

The PRs should approach the company with a grant of probate or letters of administration. Then the company secretary should amend the register of members to reflect the death and insert the name of the PR who will stand in place of the deceased.

If the value of the deceased’s estate is small (under £5,000) and the shareholding is modest, it may be possible to apply simplified procedures under the Administration of Estates (Small Payments) Act 1965. If applicable, this allows the transfer of the shares without a grant of probate or letters of administration. In lieu of probate, the PRs should produce:

- the death certificate

- the share certificate

- a statutory declaration that states their relationship to the deceased and has been signed in the presence of a solicitor

- a letter of indemnity stating that the company is not to be held liable for any consequences of the above declaration being incorrect.

The following are company secretarial tasks when dealing with a grant of probate or letters of administration following the death of a shareholder:

- Check that there is a full and exact match between the name presented and the one in the register of members.

- Check to see whether the deceased had any other holdings in the company. They may have been part of a joint shareholding as well as holding their own shares.

- Check that the PRs have returned the share certificate. If not, contact them and request it.

- In the register of members, add ‘deceased’ after the name of the shareholder.

- Record where appropriate (on the register of members itself if there is provision to do so) the date of registration of the probate/letters of administration and the names and addresses of the PR named in it.

- Annotate the share certificate with the same information added to the register of members.

- Stamp the probate and share certificate with the company’s stamp and return them to the sender.

- Keep copies of all the above documents.

- Model article 27 (for private companies) does not give PRs the right to attend or vote at general meetings until they are registered as a member. But check to see whether the company’s articles say otherwise, especially if the grant of probate has come through shortly before an AGM.

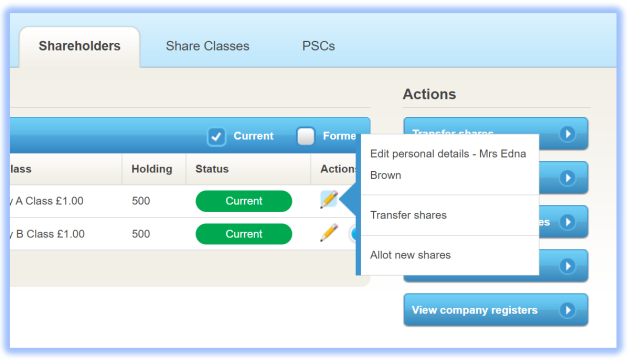

Inform Direct is the innovative and easy way to manage a company's shares, make new share allotments, record share transfers, produce share certificates and much more.

How to claim the shares investments of a diseased parent and to whom to approach ?

Thank you for your question. The deceased’s heirs would approach the company with either a grant of probate or letters of administration, depending on whether there is a will or not.