Companies sometimes consolidate shares so that the number of shares in issue is reduced but each share has a higher nominal value and hence each share has a higher market value.

In this article we explain what a share consolidation is and looks at the reasons why a company may look to consolidate its shares. We then run through and the steps a company should take to process a share consolidation.

We also give you a template resolution to amend and use to approve a share consolidation for your company’s shares.

What is a share consolidation?

A share consolidation is the opposite of a share split and, indeed, is sometimes referred to as a reverse share split. A share consolidation is where a set number of existing shares in a share class are consolidated into one share. Like a split this will not change the shareholders’ rights, meaning that following the split the rights to dividends and voting rights will be unchanged. It merely alters the number of shares and the nominal value of each share.

Share consolidation example

A company has 1,000,000 ordinary 1p shares and is valued at £1,000, giving each share a value of 0.1p. This may be seen as too low a price per share. The company therefore completes a 1,000 for 1 share consolidation which reduces the number of shares to 1,000 and increases the nominal value and share price to £10 and £1 per share respectively.

Each shareholder will, after the consolidation, have fewer shares but still own the same percentage of the shares. The shareholders’ rights, therefore, will not be changed as a result of the share consolidation.

Share consolidations will often be to consolidate every 2 existing shares into 1 share (2 into 1), 10 into 1 share or 100 into 1 share but can be to consolidate every 7 existing shares into 5 new shares.

Remainder holdings in the old share class will often arise from share consolidations as a shareholder’s holding in the old shares may not be exactly divisible by the consolidation factor. These remainder shares will need to be dealt with.

Share consolidation example with remainder shares

A company chooses to consolidate every 7 existing shares into 5 new shares.

Brett, who owns 70 shares before the share consolidation, receives 50 of the new shares.

Before the share consolidation, Selina had 50 shares. In exchange for 49 of the original shares, she receives 35 of the new shares. However, that leaves one of the original shares to deal with, as the company’s can’t issue a fraction of a share.

In this type of case, the company will often purchase and immediately cancel the remainder shares. In some cases, the shareholder will receive a payment for them.

Why consolidate the company’s shares

The main reasons for doing a share consolidation are to either tidy up the company’s share capital or reduce the number of shares received for a certain amount paid. Publicly quoted companies will sometimes do share consolidations to increase the underlying share price in an effort to make them more attractive to investors.

For instance, an investor wants to buy £1,000 worth of existing shares in a company whose shares are worth 1p per share. The investor would then receive 100,000 shares for their £1,000. If, prior to the purchase, the company consolidated every 100 1p shares into 1 £1 share the investor would receive 1,000 £1 shares for £1,000. The investor would have the same interest in the company but just a lower number of shares with a higher nominal value.

How to do a share consolidation in 7 simple steps

Here we set out the simple steps for you to complete when your company is consolidating one of its share classes, which mirror those for a share split.

If you’re not sure about the steps or their consequences, you should consider taking profession advice from your solicitor, accountant or another professional.

1 Check the Articles of Association allow a share consolidation

Your company’s articles of association no longer need to specifically allow the consolidation of shares. However, you will need to check that they do not restrict or exclude the right to consolidate. If the company was formed with the current model articles and it is still governed by them then they will not prevent you consolidating the shares.

2 Check any shareholders’ agreement

Although all shareholders will have the same interests after the consolidation as they had before, it is worth checking if there is a shareholders’ agreement and whether there are special provisions that need to be observed – for example, whether notice needs to be given before continuing with the share consolidation.

3 Consider remainder shares

The company needs to decide how any remainder shares in the old share class are to be dealt with – these will often be purchased and then immediately cancelled by the company.

4 Pass a shareholders’ resolution approving the share consolidation

Provided the company’s articles of association allow a share consolidation, this only needs to be an ordinary resolution. You can adapt and use the template resolution to consolidate shares we’ve created. Where your company only has a few shareholders it may be simplest to do this as a written resolution, but a resolution passed at a meeting of the shareholders is equally valid.

You do not need to send an ordinary resolution to Companies House but it should be kept with the company’s records.

5 Complete and file form SH02

Currently this needs to be a paper or electronic copy as Companies House do not support electronic software submission for form SH02. You will need to complete each of sections 1, 2, 3, 7 and 10 and sign at section 11. Once completed the form can either be sent in the post to Companies House or uploaded using Companies House’s document upload process.

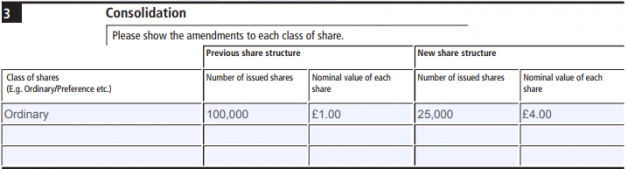

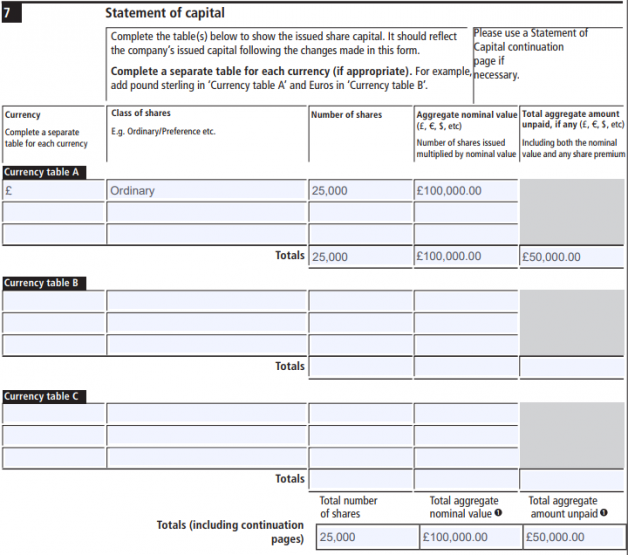

These examples of completed sections 3 and 7 show the consolidation of 100,000 ordinary shares of £1 each into 25,000 ordinary shares of £4 each (i.e. a 4 into 1 consolidation).

The prescribed particulars entered in section 10 will be the same as those of the existing shares that are being consolidated. We explain elsewhere what needs to be included within the prescribed particulars for a share class.

6 Update the register of members

The shareholders’ register and other company records must be updated to show the revised number of shares held in the new nominal value by each shareholder.

7 Issue share certificates

It is usual to send shareholders a notice that the consolidation has taken place, enclosing a new share certificate and stating that all existing certificates have been cancelled. However, it is possible that instead the old certificates may be called in for amendment.

A company can consolidate shares that are unpaid or partly paid. If you do, the proportion between the amount paid and unpaid would remain as before.

Example of partly paid share consolidation

A company currently has 100,000 ordinary shares with £1 nominal value of which 25p is unpaid, being a quarter of the nominal value. The company then carries out a consolidation of every 5 existing £1 shares into 2 new £2.50 shares, such that after the consolidation there are 40,000 ordinary £2.50 shares in existence.

The unpaid amount for these shares would be 62.5p, calculated from 25p times 5 divided by 2. Again this is one quarter of the nominal value of £2.50.

The shareholders will still have to pay the same total amount on any call on shares but just are due to pay more per each share.

Inform Direct makes a share consolidation easy. It does calculations, produces the required form, updates registers and more.

This articles was originally posted on 1 December 2015 and has now been updated to reflect that electronic versions of the form SH02 can be uploaded to Companies House using their document upload process.