Even if your company is non-trading or dormant, you must file annual accounts with Companies House.

It is vital to have a firm grasp of when to deliver company accounts to Companies House. There are substantial fines for late delivery and directors and the company secretary could face criminal prosecution. This could result in large personal fines and possible disqualification from the role of director for up to fifteen years.

In this guide we explain in simple terms how to determine when your annual accounts are due. We also explain some of the complexities that can cause the unwary to slip up, especially in their first two years of business.

Ready to file micro-entity accounts?

Inform Direct provides a simple and efficient approach to the task of producing fully compliant micro-entity accounts for private companies limited by shares or guarantee.

Before we start: two areas that commonly cause confusion

The main focus of this article is to explain the Companies House deadline that will apply to your annual accounts. But first, let’s clear up two issues that often cause confusion.

1. Annual accounts or confirmation statement?

People sometimes confuse annual accounts with the company confirmation statement. Both must be filed annually with Companies House, but they are very different in their content and the filing deadlines that apply.

What are annual accounts?

A company’s annual accounts provide details of its business activity over the accounting period (usually a year). Generally, a set of accounts would include:

- a profit and loss account

- a balance sheet

- notes explaining the accounts

- a director’s report

- an auditor’s report.

What is the confirmation statement?

The confirmation statement involves a declaration that all company details are correct as of the review date and that all necessary filings to Companies House have been made. If there are unreported changes to any of the following, they must be reported in the confirmation statement:

- The company’s registered office address, any single alternative inspection location (SAIL) and where various statutory records are kept.

- SIC codes (also known as trade classification codes).

- Details of directors, PSCs and any company secretary.

- Share capital, shareholders and any share transfers.

In this guide we consider the filing deadlines that apply to submission of your annual accounts. If you have questions regarding your confirmation statement, you may wish to start by reading our guide to the confirmation statement.

2. What is an accounting reference date?

When you first register your company, the accounting reference date is automatically set as the anniversary of the last day of the month in which the company was incorporated. Unless you change your accounting reference date, your annual accounts will be prepared to this same date every year.

Limited company accounts provide information for the financial period (usually a year) ending on the accounting reference date. The deadline for submitting annual accounts to Companies House is also determined by the accounting reference date.

Filing your confirmation statement?

File your confirmation statement the easy way in Inform Direct.

Start confirmation statementExample:

Company A is formed on 9th January 2023. Its first accounting reference date is set by legislation as 31st January 2024.

The first set of company accounts will therefore be prepared for the financial period beginning 9th January 2023 (being the day of incorporation) to 31st January 2024 (the accounting reference date). You will note that the first financial period is therefore longer than 12 months. This will be important later when we calculate the date this first set of accounts must actually be delivered to Companies House.

Unless an application to change the accounting reference date is accepted, every year annual accounts must be prepared for the financial period ending 31st January.

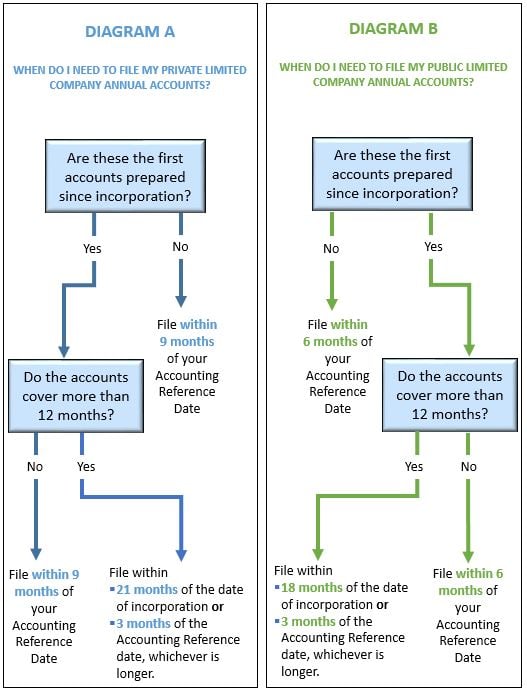

We are now ready to examine the factors that determine your annual accounts filing deadline. This is most easily explained visually, so the diagrams below show the decision process that should be followed. To determine when your company’s annual accounts must be filed with Companies House, select the relevant diagram (dependent upon your company type). Answer the questions and follow the flow to work out the latest date that you can submit your accounts.

- Use Diagram A if you are filing annual accounts for a private limited company.

- Use Diagram B if you are filing annual accounts for a public limited company.

When are your company’s first set of accounts due?

When calculating your annual accounts filing deadline you should begin by asking yourself, “is this the first set of accounts prepared for my company since it was formed?”. The filing deadlines that apply to the first set of company accounts are different from those applying for subsequent submissions. This can be summarised as follows.

If the first set of accounts covers a period of MORE THAN 12 MONTHS:

- Private companies must filewithin 21 months of the date of incorporation.

- Public companies must file within 18 months of the date of incorporation.

- Or (for either company type) – no more than 3 months after the accounting reference date –if this period is longer.

If the first set of accounts covers a period of 12 MONTHS OR LESS:

- Private companies must file within 9 months of their accounting reference date.

- Public companies must file within 6 months of their accounting reference date.

Example:

In our example above, we showed that Company A formed on the 9th January 2023 would have a first accounting reference date of 31st January 2024. Assuming that Company A is a PRIVATE company, as the first set of accounts will cover a period of more than 12 months – it will have until midnight on 9th October 2024 (21 months from the date of incorporation) to deliver its accounts.

A common mistake which causes many sets of first company accounts to be filed late is to file 21 months from the end of the month of incorporation. In this example, that date would be 31st October 2024. The accounts would be filed 23 days late and Company A would incur an automatic fine.

“A common mistake which causes many sets of first company accounts to be filed late is to file 21 months from the end of the month of incorporation.”

When are your company’s second and subsequent sets of accounts due?

Once you have filed your company’s first set of annual accounts, the deadlines that apply to second and subsequent filings are more straightforward.

- Private companies must file within 9 months of their accounting reference date.

- Public companies must file within 6 months of their accounting reference date.

Let Inform Direct help you manage all your filing deadlines

Inform Direct automatically calculates your company’s key filing deadlines. The company dashboard displays the annual accounts and confirmation statement filing deadlines. These appear alongside other key dates such as your company’s incorporation and accounting reference dates.

If you are managing multiple companies you can see all their important filing deadlines at a glance on a single portfolio screen. This, together with automatic email reminders, ensures that you are always well prepared for any approaching filing deadlines. This eliminates unpleasant surprises and Companies House late filing penalties.

Now that you have determined when your company’s annual accounts must be filed with Companies House, you may wish to look at our related guide Filing Company Accounts: Your Questions Answered. This guide looks at the questions which most commonly arise with regards to the filing of accounts and provides some straightforward answers. We also provide simple guides that explain how to calculate the size of your company and the different types of limited company accounts available (as determined by your company’s size).

All limited companies are required to file documents with Companies House. With Inform Direct, you'll get a head start on managing deadlines and making filings to Companies House.

A previous version of this article was originally published on 29 June 2015. It was updated on 16 February 2023.