Most small, standalone (non-group) private companies are not required to complete a statutory audit of their financial statements. Indeed, a research paper published in January 2017 by the Department for Business, Energy and Industrial Strategy (BEIS) estimated that

up to 90 per cent of all UK registered companies – especially smaller companies…were likely to have benefited from the Government’s small company audit exemptions in 2015, and this figure is expected to grow in the future

And it’s not surprising that so many companies decide to take up audit exemptions. Doing so can save a company both time and money.

Qualifying for audit exemption is linked to a company’s size. However, there are several other considerations that can remove eligibility, even for the smallest of companies. Let’s look at the qualifying criteria in turn and the factors that may remove the right to claim audit exemption.

In this article we will consider the regulations that apply to accounts prepared for financial years that begin on or after 1 January 2016.

Want to make it much easier to manage your UK company?

An important part of managing a UK company is keeping its statutory books and filings up to date. Inform Direct is the perfect tool to help make this task a whole lot easier.

Start nowSmall company audit exemption – what’s the starting point?

Section 475 of the Companies Act 2006 states that:

a company’s annual accounts for the financial year must be audited…unless the company is exempt from audit.

And, this should always be the starting point. Your company accounts are subject to statutory audit until it can be shown that they qualify for audit exemption.

However, the Companies Act 2006 also sets out various scenarios which may allow a company to qualify for audit exemption. These are prescribed in the following sections:

- Section 477 – qualifying small companies

- Section 479A – eligible subsidiary companies

- Section 480 – dormant companies

- Section 482 – non-profit making companies subject to public sector audit

In this article we will consider how an individual (non-group) company may qualify for audit exemption. If your company is a member of a group, our related guide will help you to consider whether your UK subsidiary is exempt from audit.

Does your company qualify as a ‘small’ company?

The size of a company, as defined by the Companies Act 2006, is important. It influences the type of accounts the company may choose to prepare. It dictates the minimum amount of information that must be included for the public record. It also determines whether the financial statements must be audited or not.

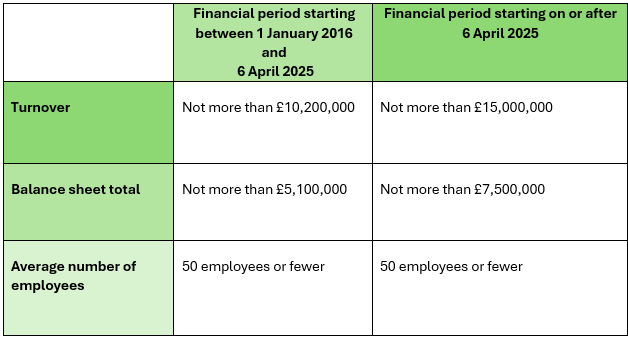

Section 477 allows eligible ‘small’ companies to apply audit exemption. Section 382 defines the size criteria that determine whether a company is ‘small’. The thresholds were updated by The Companies (Accounts and Reports) (Amendment and Transitional Provision) Regulations 2024, with the new increased thresholds (shown in the table below) applying for accounting periods starting on or after 6 April 2025:

The company will qualify as ‘small’:

- In the first year of trading: if it can meet at least two out of three of the above criteria.

- In subsequent years: unless it exceeds two of the above three size criteria for two years in a row.

There are a couple of important points to note here:

- The maximum turnover figures quoted in the table above apply where the accounting period is 12 months in length. If the accounting period is shorter or longer than a year, the threshold values should be adjusted proportionately.

- Micro-entities qualify as ‘small’ companies for the purposes of determining eligibility for audit exemption.

- The above size criteria do not apply to charities. There are separate charity audit thresholds.

Further advice on all of the above and on how to apply the ‘two consecutive financial years’ rule can be found in our guide entitled ‘How to calculate company size for year end accounts preparation‘.

Having determined that your company qualifies as a ‘small’ company, you should next consider its eligibility. It is important to note that there are certain types of company that never qualify for audit exemption.

Could my company be ineligible for audit exemption?

Section 478 of the Companies Act 2006 prohibits some small companies from audit exemption, including the following:

- Public companies

- Authorised insurance companies and companies that carry out insurance market activity

- Banking companies, e-money issuers, MiFID investment firms and UCITS management companies

- Trade unions and employers’ associations

- Pension bodies

What about dormant companies?

Section 480 states that a company will qualify for audit exemption if it has been dormant either since formation or for the whole of the accounting period concerned. This is provided that it qualifies as a small company or would have so qualified but for being a public company and is not required to prepare group accounts for that year. Section 481 prescribes the dormant companies that can never apply audit exemption. This includes:

- companies whose shares are traded on a regulated market

- authorised insurance companies

- companies that carry out banking activities

- e-money issuers

- UCITS management companies.

My company qualifies for audit exemption – can it still be required to obtain an audit?

Having determined that your company does qualify for audit exemption you should be aware that there are still occasions when the company may be required to obtain a statutory audit of the accounts. These include:

1 The rights of members to require an audit

Section 476 allows an individual or a group of shareholders controlling at least 10% of the nominal share capital or at least 10% of any class of shares to request in writing that the company obtain an audit. The request must be sent to the company’s registered office address. It must be received by the company at least one month before the end of the financial year concerned. Similarly, a limited by guarantee company is required to obtain an audit if not less than 10% in number of the members of the company request it.

2 The required statutory statements are not included on the balance sheet

Section 475 of the Companies Act 2006 states that a company will not be entitled to audit exemption unless the required statements are included on the balance sheet above the authorising signatory.

For audit exemption to apply the following statements must be included on the balance sheet:

“For the year ending [insert year end date] the company was entitled to exemption from audit under section 477 of the Companies Act 2006 relating to small companies.

The members have not required the company to obtain an audit of its accounts for the year in question in accordance with section 476.

The directors acknowledge their responsibilities for complying with the requirements of the Act with respect to accounting records and the preparation of accounts.

These accounts have been prepared in accordance with the provisions applicable to companies subject to the small companies’ regime.”

3 The articles of association require an audit

The accounts of the company must be subject to an audit if the company’s articles of association require it. Many companies adopt model articles of association which do not contain a provision requiring the company to obtain an audit. However, if you find that the company’s articles do contain such a provision, it can be easily removed with shareholder approval. Refer to our guide on how to change a company’s articles of association.

When might a company choose to audit its accounts?

Even if you determine that your company does qualify for audit exemption you can still choose to obtain a statutory audit, and there may be many reasons to do so. A Department for Business, Energy and Industrial Strategy 2017 publication entitled “The impact of exempting small companies from statutory audit” found respondents cited the following reasons for choosing not to take up audit exemptions:

- The company is likely to exceed the eligibility thresholds and require an audit soon.

- To meet requirements imposed by lenders and preconditions for loans.

- To provide comfort and confidence to shareholders, directors, investors and suppliers.

- To meet the requirements of regulators or trustees.

- To accord with decisions made at a group level that audits be undertaken by all companies in the group.

- To improve the perceived credibility or reputation of the company.

- A belief that audits represent good financial practice.

- Simple inertia!

Our streamlined wizard for efficient micro-entity accounts production makes it easy to get it right first time.

An earlier version of this article was published on 27 May 2022. The article was fully updated on 13 May 2025.