Responding to customer requests, we’re pleased to be releasing a helpful new feature this month.

If you operate a subscription account and complete VAT returns for your clients, you are now able to grant Inform Direct the authority to automatically retrieve client VAT dates from HMRC. We’ve created a really simple process to enable you to do this, and doing so will bring the following benefits:

- The ‘Next VAT due date’ will be automatically updated and displayed in the ‘Key Dates’ section of each company dashboard. A counter indicates the number of months, weeks or days until the next filing is due. Colour changes from green to amber to red provide an effective visual cue when the submission deadline is approaching.

- An email reminder will be sent 7 days before the client VAT return is due to be submitted and if necessary, again on the latest date to file the return.

- You can tailor your Portfolio page to display customer VAT due dates and sort the data so that it is easy to prioritise your workload.

Subscribing brings lots of benefits

Display client VAT due dates on your Portfolio screen and receive email reminders when a VAT deadline is approaching. Just one of the many benefits an Inform Direct subscription can bring.

Grant Inform Direct authority to link with HMRC

It takes moments to grant Inform Direct the authority to link to HMRC Making Tax Digital (MTD) VAT. Users that have the role of Administrator, or Managers with edit access to the ‘Accounts’ area can grant the authority.

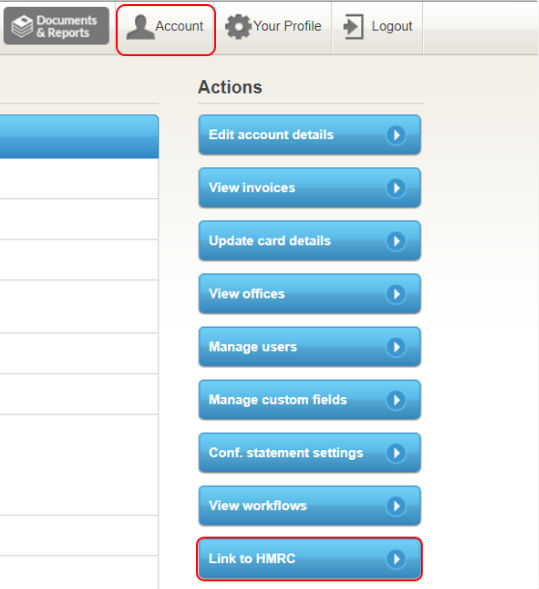

Start the process by heading to the ‘Account’ area and clicking on the blue ‘Link to HMRC’ button:

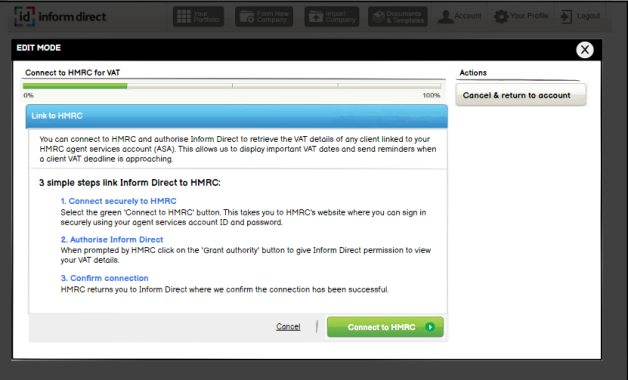

A screen explaining the process will be displayed. Click on the green ‘Connect to HMRC’ button to confirm that you wish to continue:

- You will be directed to an HMRC webpage where you will be asked to sign in securely using the login credentials and password of your agent services account (ASA).

- You will also need the device that you normally use to complete two factor authentication.

- Ensure that you use the agent services account credentials for your practice. This will be the HMRC account linked to your firm’s Unique Tax Reference (UTR) and also the HMRC account that you have linked your clients to.

HMRC will ask you to click on a button to confirm that you ‘Give permission’ and having done this you will be redirected back to Inform Direct.

Add customer VAT registration numbers

Once you have granted Inform Direct the authority to link to HMRC MTD VAT, we can automatically retrieve and update the VAT dates of your client companies. We can do this for any company linked to your ASA – as long as you have input their VAT registration number into Inform Direct.

If you have fewer than 50 customer companies it is quickest to add these manually for each individual company.

Simply:

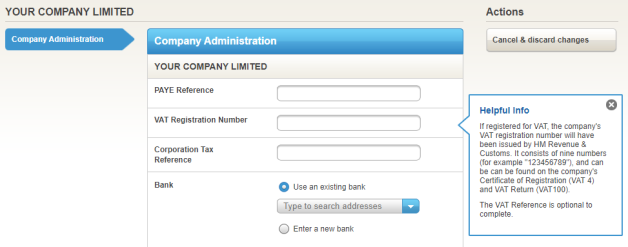

- Go to the ‘Company’ area and click on the blue ‘Update company admin’ button.

- Enter the required data into the ‘VAT Registration Number’ field.

The VAT registration number usually consists of either 9 or 12 digits and can occasionally be preceded by two letters.

If you have more than 50 client companies in your portfolio, you may wish to take advantage of our bulk import service. For further details of this process refer to our guide on how to bulk upload your client VAT registration numbers.

Removing the authority

It takes just two clicks to remove the authority Inform Direct has to retrieve VAT dates from HMRC, and you can remove the link at any time. From the ‘Account Details’ page simply click on the blue ‘Remove HMRC link’ button. A message will display asking you to confirm that you wish to remove the authority and you can do this simply by clicking on the green ‘Remove HMRC link’ button. Remember, once you have done this Inform Direct will no longer be able to automatically retrieve your client VAT dates and you will now have to manually update them.

Let us know what you think

Please do let us know what you think of this or any other features in Inform Direct. We are always looking for ways to enhance our service and receiving your feedback is key to this process.

You can also take a look at our timeline of updates, and see our continuing commitment to improve Inform Direct in progress.

nice feature as ever!