While a Person with Significant Control is generally by definition an individual, it is not only individuals who can be recorded in a company’s PSC register.

In this article, we look at the circumstances when a corporate entity must be included in a PSC register and what details must be obtained and recorded. Elsewhere, we look at the process a company should follow to identify its PSCs and RLEs and put together the register.

To be classed as a registrable relevant legal entity (or registrable RLE) – a mouthful, but essentially meaning they must have their details recorded in a company’s PSC register – a corporate entity must meet three conditions:

Inform Direct makes it easy to keep track of PSCs and RLEs

Inform Direct:

>Records efforts to identify PSCs and RLEs

>Produces board minutes, template notices and proforma reply letters

>Submits changes automatically to Companies House

Condition A: It would need to have been classed as a person with significant control if it had been an individual. That means it must meet at least one of the following conditions:

- Hold more than 25% of the company’s shares

- Hold more than 25% of the company’s voting rights

- Have the power to appoint or remove a majority of the company’s board

- Have the right to exercise or actually exercise significant influence or control over the company

- Have the right to exercise or actually exercise significant influence or control over a trust or a firm that is not a legal entity which itself satisfies any of the first four conditions.

Condition B: It meets certain ‘transparency’ criteria. Specifically, to be an RLE the entity must either:

- Be required to keep its own PSC register; or

- Have voting shares admitted to trading on a regulated market in the UK, a state in the European Economic Area or in a specific named market in the USA, Japan, Switzerland or Israel. These markets are listed at the end of this article.

To qualify as an RLE, an overseas company will therefore usually need to be listed on one of the named regulated markets. An overseas company that does not meet any of the three criteria under Condition B cannot be an RLE. To identify a PSC of such an overseas company it will be necessary to look further up the ownership chain.

Condition C: It is the first corporate entity in the company’s ownership chain that satisfies condition A and B.

Let’s use some examples to see how those conditions play out in practice.

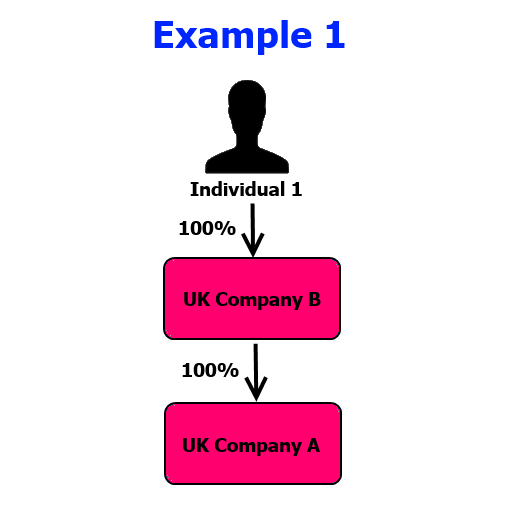

In Example 1, Company A is fully owned by Company B, which is also a UK company subject to the PSC register requirements. As a registrable relevant legal entity, Company B’s details should be listed in Company A’s PSC register. It will be noted as meeting each of control conditions 1, 2 and 3 listed above.

Unless there is someone else who has special rights to appoint or remove a majority of the board, or exerts ‘significant influence or control’, Company B will be the only person recorded in A’s PSC register. Because Company B is an RLE which is included, Individual 1 does not need to be included in Company A’s PSC register, despite the fact they exercise ultimate control over it. Individual 1 will, however, be recorded in Company B’s PSC register.

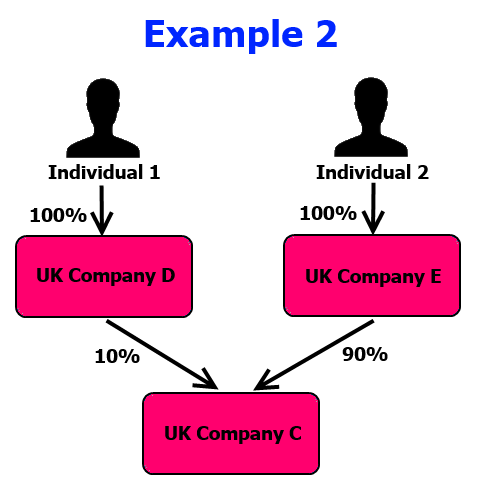

Example 2 illustrates that only companies that meet one of the five control criteria need to be included in the PSC register.

Because it holds 90% of the shares in Company C – and probably therefore also controls 90% of the voting rights and has the ability to appoint a majority of the directors – UK Company E will be treated as a relevant legal entity. It must be included in C’s PSC register.

As E is a registrable RLE for Company C, Individual 2 does not count as a PSC for C (although they will be included in Company E’s PSC register).

Despite the fact it holds shares in C, Company D will not appear as a RLE in its PSC register because it doesn’t meet the condition of holding more than 25%. Neither will Individual 1 be included in C’s PSC register, although they will appear in D’s register.

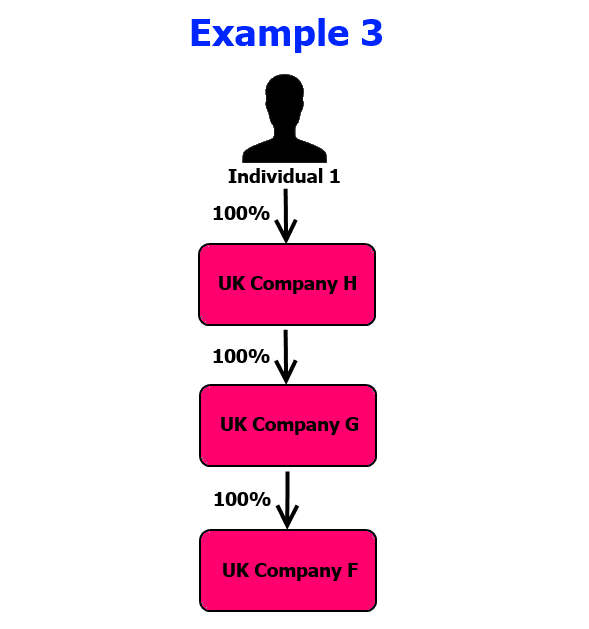

In Example 3, Company G will be included in F’s PSC register as the first corporate entity in the company’s ownership chain. Because G’s details are listed in F’s PSC register, H won’t appear – despite being a UK company that is itself subject to the transparency requirements. H is not the first relevant corporate entity in F’s ownership chain. While H is a relevant legal entity, it is not also registrable for Company F. This avoids duplicate disclosure.

However, H is the first relevant corporate entity in Company G’s ownership chain, so will be listed in G’s PSC register.

Because a relevant legal entity further down the chain has been included in the PSC register for the other companies, the only PSC register in which Individual 1 will be listed is Company H.

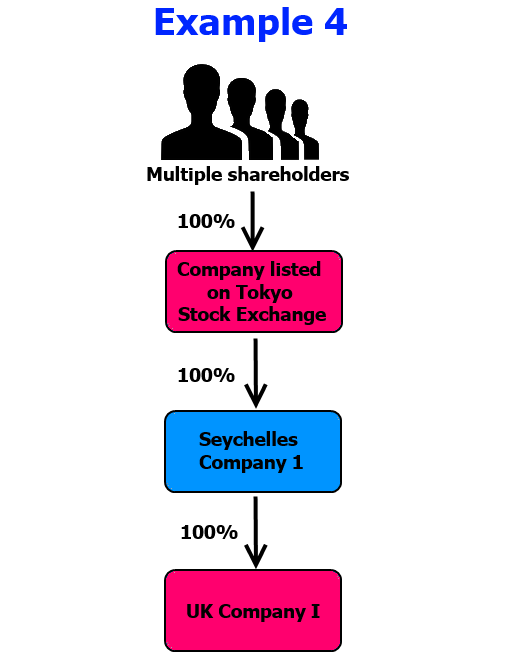

Company I in example 4 is also part of an ownership chain.

Its immediate corporate owner, however, is based in the Seychelles and therefore does not meet the transparency requirements. This company is not a relevant legal entity and will not appear on Company I’s PSC register.

The directors of I will need to look further up the chain of ownership. The next entity in the chain is a Japanese company. While this company won’t keep its own PSC register, it is listed on a market specified in the legislation – in this case the Tokyo Stock Exchange. This company will therefore be the one included in I’s PSC register.

As a listed company, the Japanese company is likely to have a number of shareholders. Even if there was a majority shareholder, however, that individual will not be included in Company I’s PSC register because the Japanese company itself is already listed as an RLE.

What information about a relevant legal entity goes in the register?

For a relevant legal entity, the register must contain the corporate entity’s:

- Name

- Registered / principal office (effectively as a service address)

- The company register or other register on which the company appears – this might for example be the UK company register, the Charity Commission register or the central register of companies in another country

- The company’s registration number or reference

- The legal form of the entity

- The law under which the RLE is governed

- The date on which the relevant legal entity became registrable

- The nature of their control over the company – which of the conditions above the RLE meets and, for shareholdings and voting rights, which of a number of discrete bandings they fall into

Unlike the details of an individual PSC, a registrable relevant legal entity’s details do not need confirmation. Therefore, as soon as they are known, the details can be included in the PSC register.

Approved regulated stock exchanges for RLE status

Israel

- Tel Aviv Stock Exchange

Japan

- Fukuoka Stock Exchange

- Nagoya Stock Exchange

- Osaka Securities Exchange

- Sapporo Securities Exchange

- Tokyo Stock Exchange

Switzerland

- BX Berne Exchange

- SIX Swiss Exchange

USA

- BATS Exchange, Inc.

- BATS Y-Exchange, Inc.

- BOX Options Exchange LLC

- C2 Options Exchange, Incorporated

- Chicago Board Options Exchange, Incorporated

- Chicago Stock Exchange, Inc.

- EDGA Exchange, Inc

- EDGX Exchange, Inc

- International Securities Exchange, LLC

- ISE Gemini LLC

- Miami International Securities Exchange LLC

- NASDAQ OMX BX, Inc.

- NASDAQ OMX PHLX LLC

- The NASDAQ Stock Market LLC

- National Stock Exchange, Inc.

- New York Stock Exchange LLC

- NYSE Arca, Inc.

- NYSE MKT LLC

Inform Direct keeps companies compliant with PSC and RLE legislation.

It supports all the different possibilities prescribed by law - but keeps it simple for users.

This article was originally published in 2016. The most recent update was in September 2023.

Thank you Johnathan your article have been most helpful. We are currently dealing with a rogue company and they are ducking and diving – not being transparent.

Great keep up the good work

Thanks for your kind words. Good luck with resolving the situation.