A charge, or mortgage, refers to the rights a company gives to a lender in return for a loan. The rights are often in the form of security given over a company asset or group of assets.

Almost all charges should be registered with Companies House. Company officers need a good understanding of what is required when it comes to registering a charge.

This article considers the questions that most frequently arise with regards to registering a charge at Companies House. It explains the registration process and what happens if you fail to register a charge within the permitted time period.

The quick and simple way to register a charge

File your form MR01 electronically using our simple step by step process.

Who can register a charge with Companies House?

Section 859A (2) of the Companies Act 2006 states that ‘the company or any person interested in the charge’ may deliver a form MR01 to Companies House. In practice it is usually the company, the lender, or legal or accounting firm representing either.

Should all charges be registered with Companies House?

If in doubt … it is always prudent to file an MR01 to register the charge. There are no significant disadvantages to doing so.

The Companies Act 2006 (Amendment of Part 25) Regulations 2013 simplified the requirements such that almost all charges must now be registered. The only exemptions quoted are for:

- Rent deposit deeds

- Pledges and liens over property

- Charges ‘ … created by a member of Lloyd’s … to secure its obligations in connection with its underwriting business’

- Charges excluded from registration ‘under any other Act.’ This would include charges excluded by the Financial Collateral Arrangements (No 2) Regulations 2003.

A company no longer commits a criminal offence if it fails to register a charge. However, serious consequences can still result. Failure to register a charge can void the security it would otherwise provide on a company’s property. If in doubt, therefore, it is always prudent to file an MR01 to register the charge. There are no significant disadvantages to doing so.

Is there a deadline for submission of form MR01?

Yes. Applications for registering a charge at Companies House (for newly created charges) must be made within 21 days beginning with the day after the date of creation of the charge. See below for what can be done if this deadline is missed.

How do I register a newly created charge?

As an alternative to the traditional paper MR01 route, it is now possible to file the registration electronically. The benefits of software filing your application are numerous. It is quicker, easier, more secure and cheaper than the traditional paper filing process. Online filings are usually processed within 24 hours. This allows more time and makes it less stressful to correct any unforeseen issues within the 21-day filing deadline.

The steps to follow are:

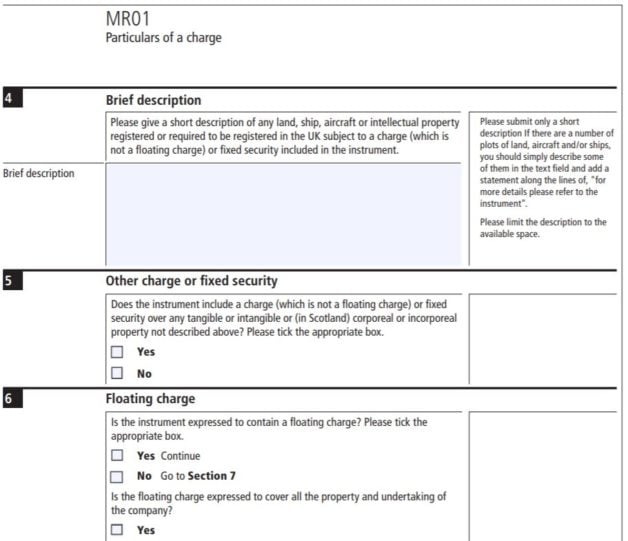

- Complete form MR01 (or LLMR01 if the charge has been created by a Limited Liability Partnership). You will need to disclose the charge creation date, the name of the person(s) entitled to the charge, a brief description of the charge and answers to some questions about the nature of the charge.

- Attach a certified copy of the deed or document supporting the newly created charge. This must be signed by the charging company (the lender). A PDF version of the deed document can be delivered to Companies House to support an electronic mortgage registration application.

- Pay the registration fee.

- Once the MR01 has been accepted, Companies House will issue a certificate of the registration of a charge. This certificate should be carefully retained. It includes the 12-digit unique reference code that Companies House will require for any updates to the charge in future.

Can details be redacted from the copy of the charge deed held on the public record?

Only prescribed, very limited personal information can be redacted from the copy of the charge document held on the public record. The details that can be redacted are:

- Personal information relating to an individual, other than the name of the individual.

- The number or other identifier of a bank account of a company or individual.

- A signature.

What happens if a charge is not registered within 21 days?

Missing the 21-day deadline means that whilst the charge remains due for repayment it is now effectively unsecured. Any security granted over the company’s assets by the charge is now ‘void’ against any liquidator, administrator or other creditor.

Before the Companies Act regime was simplified, failure to register a registrable charge was considered a criminal offence. The offenders were both the company and every officer who could be deemed negligent. With the amended Act, registration of a charge is no longer compulsory and criminal responsibility has been removed.

However, missing the 21-day deadline means that whilst the charge remains due for repayment it is now effectively unsecured. Any security granted over the company’s assets by the charge is now ‘void’ against any liquidator, administrator or other creditor.

Leaving creditors in this exposed position means that it will be difficult for them to recover the debt in the event of the company becoming insolvent. This is why it is often the lender or their representative who registers the charge.

When can the time limit for registration of a charge be extended?

An application to the courts to extend the period allowed to file form MR01 is likely to succeed where the failure:

- ‘… was accidental or due to inadvertence or to some other sufficient cause’

- ‘… is not of a nature to prejudice the position of creditors or shareholders of the company’.

More broadly, a court order to extend the period of registration will also be granted if to do so is considered ‘just and equitable’.

Note that charges that have been granted an extended period of registration cannot be software filed or web-filed. Instead, a paper form MR01 must be submitted together with the court order permitting the extended period of registration.

How do I apply to extend the time allowed to file form MR01?

If a newly created charge is not or cannot be registered within the statutory time frame, an application can be made to the Companies Court to extend the period of registration. The application can be made by the company, the entity that created the charge (i.e. the lender) or any other person that has an interest in the charge. This may be a legal or accounting firm acting on behalf of either the chargor or chargee.

A number of steps must be followed in order to obtain the court order allowing extension of the period of registration:

- Complete Claim Form (CPR Part 8). You should include on the form an explanation of the circumstances that resulted in the failure to meet the statutory deadline.

- Complete a claim for an order extending time for registering a charge. This includes a witness statement in support of the explanation for the failure to meet the statutory deadline. For example, it may be an explanation that it was due to inadvertence, accident or some other ‘sufficient cause’. Confirmation is required that grant of an extension would not prejudice the position of the creditors or shareholders of the company. Additionally, an extension should be a ‘just and equitable’ outcome.

- Attach a copy of the charge deed to the witness statement in support. The original charge deed must be provided to the registrar at the application hearing.

- Serve a copy of the above documents on the company to whom the charge applies, if the application to extend the registration period is not being made by them.

- Pay a court fee at the time of lodging the application.

- Provide evidence of solvency. A director or company secretary of the company to whom the charge applies must sign a statement confirming that:

- No winding up order has been made against the company or resolution for voluntary winding up of the company been passed

- No winding up petition is pending

- No notice of a resolution to wind up the company has been given or is planned

- The company continues to carry on business

- There are no unsatisfied judgments against the company and that no creditor can recover judgment against it.

This signed statement must be filed with the Companies Court no later than two clear working days before the hearing.

Once the above steps have been completed, a hearing will take place at the registrar’s chambers. Once the court have agreed to the extension they will provide two copies of the order. The charge can now be registered by attaching a copy of the court order to a paper form MR01. Applications where the registration period has been extended can only be paper filed with Companies House.

How can Inform Direct help you manage company mortgages and charges?

Subscribers with their own Companies House presenter code can use Inform Direct to register, satisfy and release, in part or in full, their mortgages and charges. Inform Direct includes the following specially designed features:

- Mortgage summary: clearly displays all the details of your company mortgages and charges.

- Regular synchronisation with Companies House: ensures that the details of your mortgages and charges held within Inform Direct are up to date and complete and reflect the public register at all times.

- Electronic filing: Inform Direct breaks down each process into manageable, simple steps. It ensures you provide the correct details, on the correct form and in the correct format, before submitting your charge details to Companies House electronically. Whether you are registering a new charge or satisfying/releasing an existing charge, the whole process takes moments.

- Register of mortgages: Inform Direct provides a fully compliant register of mortgages and charges which updates automatically after any mortgage or charge transaction.

- Provision of template documents: Inform Direct will offer you relevant template board minutes and resolutions to support your mortgage transaction. They will be pre-populated with the details you have already entered.

Visit the Inform Direct website to learn more about these features

Inform Direct makes electronic submission of your application for registration of a charge easy. Benefits include automatic update of statutory registers and professional board minutes prepopulated with the details of your registration.

Question: Does all the above still apply if the lender company is none regulated

Hi, thanks for your question. The requirements of The Companies Act 2006 (Amendment of Part 25) Regulations 2013 apply regardless of whether the lending company is regulated or not. It is usually advisable to register a charge as there are no significant disadvantages to doing so, and this may be even more so the case where the lender is not regulated and the protections offered by the Financial Conduct Authority (FCA) are not available.