Blog

Blog

Guides, opinions and more...

Here we set out the main things to consider when preparing a form of proxy before a members’ meeting such as an AGM and provide a free downloadable form of proxy template. …

Does my company need a company secretary?

Since 6 April 2008 limited companies have no longer been required to appoint a company secretary. However, even though appointing a company secretary is no longer compulsory for limited companies, many still choose to.…

What is a PSC register?

From 6 April 2016 the vast majority of UK companies, even the smallest companies owned by a single person, must keep a Register of People with Significant Control (also known as a “PSC Register”). This register sits…

What is a dormant company?

Your company may be considered dormant if it is not currently carrying out any business and it does not have any other sources of income, including investment income. This article explains what to do and what to avoid doing in…

What are Company Share Option Plans (CSOPs)?

Company share option plans (CSOPs) are tax advantaged discretionary employee share option schemes. They allow companies to issue options to any employee or full time director to buy shares.…

Authorised share capital: is it still relevant?

Authorised share capital defined a maximum value of shares that a company could issue. Until 2009 it was compulsory to include it in the memorandum of association. After 2009 it is no longer required to have a limit on share…

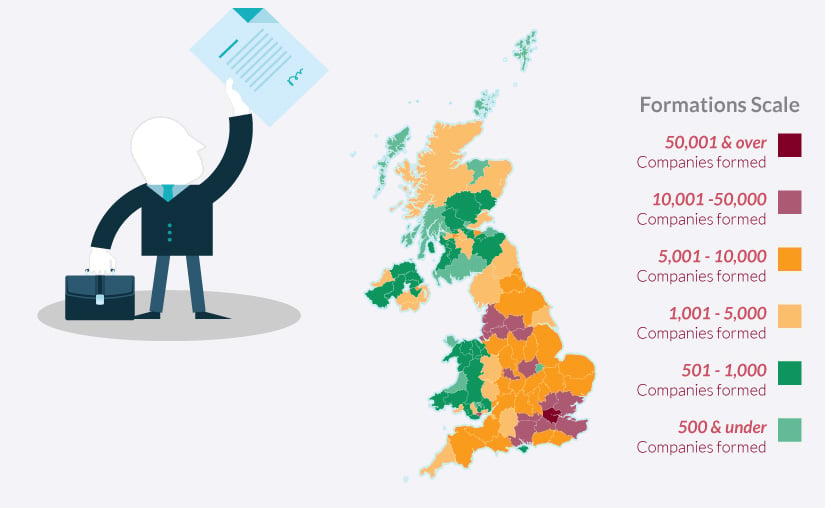

2025 Review

of UK Company Formations

Read our comprehensive review of UK company formations in 2024, year-on-year growth rates and breakdown by county. This detailed insight is provided in the form of easy to understand infographics available for sharing through social media and on your own website