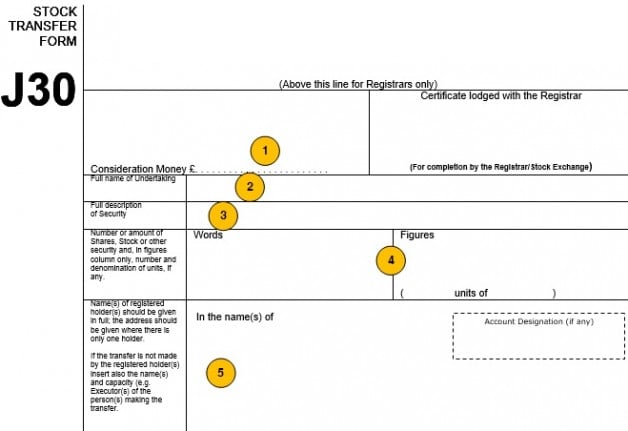

A stock transfer form (also known as form J30) is the standard document required for the transfer of shares in the UK. It contains details of both the seller and buyer of the shares, the type and number of shares being transferred and the amount paid by the buyer. This article is part of a series looking at the share transfer process, aimed both at companies and buyers and purchasers of shares.

Our template J30 stock transfer form can be used for share transfers of fully paid shares, which are most common. The guide below describes how to fill in each section of the form.

If you’re transferring unpaid or partly paid shares, which are less common, read our guide to the J10 form that should be used instead. We also have a J10 form template you can download.

Once the form is completed and the company has accepted the transfer, details from the stock transfer form will need to be recorded by the company.

In some cases, the form must be sent to HMRC – we explain below when this is required.

Discover the easier way to process share transfers

In Inform Direct, produce pre-populated stock transfer forms, branded share certificates with automatic updates to online statutory registers.

It’s standard practice to complete a stock transfer form in BLOCK CAPITALS and in black ink. If you make a mistake, cross it out, make the change and initial it (or start again). Don’t use correction fluid or stick labels on the form.

1 Consideration money

Where shares are being transferred for cash, enter the amount of money being paid here. If no money is to be paid for the shares, enter ‘NIL’ instead.

2 Full name of Undertaking

Enter the name of the company in which the shares are held here.

3 Full description of Security

Enter the class or type of shares being transferred via the stock transfer form – for example, Ordinary shares of £1.00. The description to be used can be found on the share certificate which covers these shares.

4 Number or amount of Shares, Stock or other security

Complete the number of shares you wish to transfer, in both words and figures. If shares or stock are packaged into units, you should also specify the number of units in the box to the right.

5 Name(s) and address of registered holder(s)

This should include the names of the current shareholder or, for a joint shareholding, all joint shareholders. Only one address should be entered, which for a joint shareholding should be that of the first named joint shareholder.

If someone other than the named shareholder is transferring the shares, please also write the capacity in which they will be signing the stock transfer form. For a deceased shareholder, for example, the full names of the legal personal representative(s) should be included.

The ‘Account designation’ box only needs to be completed if there is a specific account designation or reference attached to the existing shareholding.

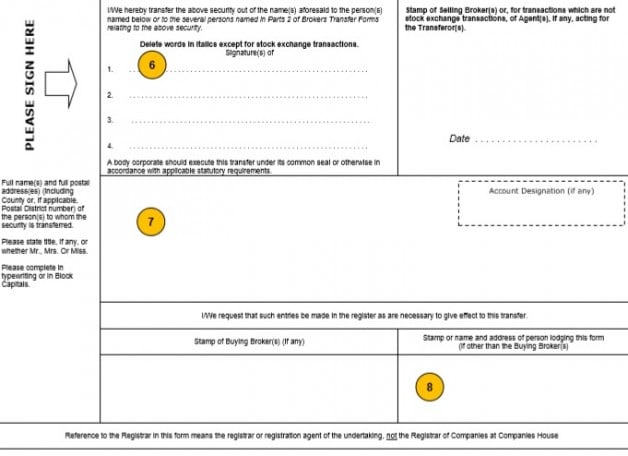

6 Signature(s)

This is the signature of the person transferring the shares. It usually be the seller (or sellers, as all joint holders should sign to transfer a joint shareholding), but there are a few instances where someone else may sign stock transfer forms here:

- The legal personal representatives should sign on behalf of the estate of a deceased shareholder.

- Where a Power of Attorney has been registered with the company, the attorney may sign on the seller’s behalf.

- A corporate shareholder registered in England, Wales or Northern Ireland requires a combination of officers to sign, with each stating the capacity in which they sign and that they are signing for the company (e.g. for and on behalf of NewCo Limited):

- Two directors

- One director and the company secretary

- One director and a witness, who must also state their name and address

- Two authorised signatories

The combinations required will be different if a company seal is applied.

You should also enter the date that the transferor(s), or another person arranging the transfer on their behalf, has signed the stock transfer form.

7 Name(s) and address of person(s) receiving the shares

Enter the details of the person(s) in whose name(s) the shares are now to be registered. For proposed joint shareholdings, this should include the name of each joint shareholder. However, only the address of the first named shareholder should be entered: it is this address to which correspondence in respect of the shares will be sent.

The aim will often be to register the shares in the name of a corporate or other entity rather than an individual person. However, transfers will generally only be registered if the receiving party is a public limited company, private limited company, incorporated under Royal Charter, incorporated by special act of Parliament or under applicable foreign company law. This will mean that, in at least some cases, shares will be transferred to the underlying individuals or trustees involved with a charity, trust, association, or club rather than to the entity itself.

The ‘Account designation’ box only needs to be completed if the shares are now to be held under a specific account designation or reference.

8 Stamp or name and address of person lodging the stock transfer form

If the new share certificate should be sent to someone other than the first-named person receiving the shares stated above, their name and address should be included here.

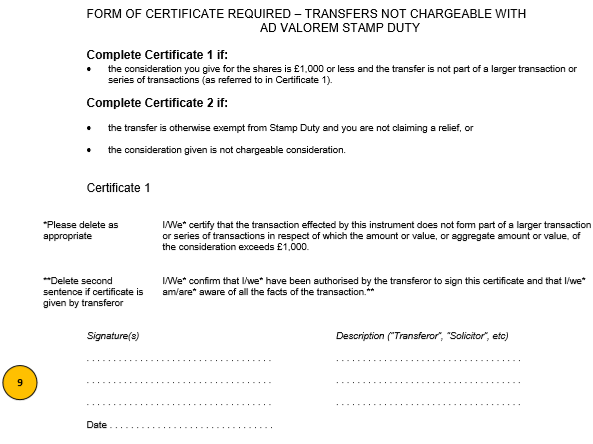

9 Certificate 1

Certificate 1 of stock transfer forms should be completed if the money paid for the transfer £1,000 or less. If this is the case, so long as the certificate is fully completed no stamp duty will be due.

You should delete “I” or “We” as appropriate in each place they appear.

Where it applies, the certificate should be signed by either the person(s) that sign(s) the transfer, their solicitor or their authorised agent. The person signing should state the capacity in which they sign and also date the certificate.

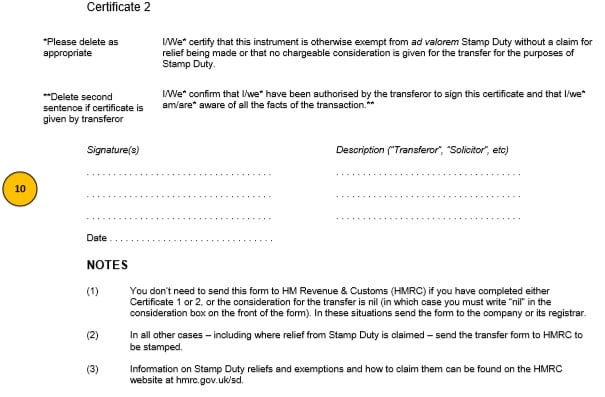

10 Certificate 2

Certificate 2 of the stock transfer form should be completed in the following scenarios where stamp duty is not chargeable:

- Shares you receive as a gift and that you don’t pay any money or other consideration for;

- Shares you receive from your spouse or civil partner when you marry or enter into a civil partnership;

- When any shares are transferred to you as a security for a loan;

- Shares that were held as security for a loan that are now transferred back to you when you repay the loan;

- Shares held in trust when they are transferred from one trustee to another;

- When any shares are transferred to you as a security for a loan;

- Shares that were held as security for a loan that are now transferred back to you when you repay the loan;

- Any transfer made by a liquidator as settlement to shareholders when a company is wound up.

However, if any of these conditions apply and the consideration for the shares is stated as nil on the front of the stock transfer form, neither certificate needs to be completed. In that case, the stock transfer form does not need to be sent to HMRC and there will be no stamp duty to pay.

Some transactions are exempt from stamp duty and also covered by Certificate 2. You should therefore complete this certificate if:

- Shares have been left to you as part of a Will;

- Shares are transferred if you get divorced or if your civil partnership is dissolved; or

- Exempt stocks such loan notes, permanent interest bearing shares or debentures are being transferred.

Once again, where Certificate 2 applies you should delete “I” or “We” as appropriate in each place they appear and the certificate should be signed and dated as appropriate.

Where these exemptions apply and Certificate 2 has been fully completed, the stock transfer form neither needs to be stamped or sent to HMRC. There will be no stamp duty payable.

There are also some types of transfer which can qualify for relief to reduce the amount of stamp duty due or eliminate it entirely. You can find out more about these specific reliefs, the circumstances in which they apply and how to make a claim in the stamp duty section of HMRC’s website.

If you’d like more information on how a stock transfer form is used, when stamp duty applies or other aspects of the share transfer procedure, check out our handy guide to transferring shares.

Produce stock transfer forms, share certificates, company registers and board minutes for share transfers

A previous version of this article was originally published in 2013.

Very informative. Thanks

very concise and informative

Excellent – very helpful

Thank you for clarifying and reassuring me. I think I have completed the form correctly. (We’ll see.)

Superb, very clear. Many thanks

Brilliant thank you. Just getting in a bit of panic after husband died.

But this has explained it simply.

Very helpful! Thanks a lot!!

Really glad you found it helpful, Jennifer!

Thanks for this. I thought I was doing something simple until I saw the form. I cannot believe in this day and age that lawyers are still allowed to put out this kind of thing without it being in plain English – very pompous. Thank you again for interpreting the past!

This is amazingly helpful – very grateful to you for making this clear advice available.

I can only echo the comments above. Exactly what I needed as my accountant and solicitors seemed to be unable to clarify the situation as well as you have. Many thanks.

You’ve saved me from my dreaded course work – thank you !!

Excellent explanation that has stood test of time! Sincerely appreciated-thank you

Great help. Thank you.

Really helpful. Thank you.