From 1 August 2022 overseas entities with a relevant interest in UK land must add themselves to the Register of Overseas Entities held at Companies House and provide details of their beneficial owners. Here is information on whom it affects, what it means, and how and when to register an overseas entity.

Introduction

The Register of Overseas Entities (ROE) at Companies House is an initiative by the UK government to trace the ownership of UK property held by non-UK companies.

It is part of the Economic Crime (Transparency and Enforcement) Act 2022 (ECTE Act), which is intended to crack down on unexplained wealth in the UK and make it harder to hide ‘dirty money’ in the form of UK land and property.

In this article we explain what the Register of Overseas Entities is, define its terms, and outline what to do if you (or your clients) find yourself affected by it.

From 1 August 2022 overseas entities with a relevant interest in UK land must add themselves to the Register of Overseas Entities held at Companies House and provide details of their beneficial owners. The entity receives a unique overseas entity ID upon registration which it must provide to the Land Registry.

Failure to register will lead to the property being frozen. The Land Registry will disallow all transactions involving the property, meaning it cannot be bought, sold, transferred or leased. There is also a fine of £2,500 per day and a possible prison sentence of up to 5 years.

From 1 August 2022 overseas entities with a relevant interest in UK land must add themselves to the Register of Overseas Entities held at Companies House and provide details of their beneficial owners.

Who can apply to be on the Register of Overseas Entities?

Depending on the particular circumstances, any of the following parties may be required to apply to be added to the Register of Overseas Entities before 31 January 2023.

- Beneficial owner of an overseas entity that owns or has an interest in property in the UK

- Managing officer of such an overseas entity

- UK-regulated agent of such an overseas entity (e.g. lawyer, fund manager, trust manager)

- Non-UK agent that directly represents such an overseas entity.

Failure to register will lead to the property being frozen … there is also a fine of £2,500 per day and a possible prison sentence of up to 5 years.

Below we explain what the terms used in the ROE mean and what information needs to be supplied to Companies House when an overseas entity applies to be added to the register.

What is an overseas entity?

The government defines an overseas entity as a non-UK company or other organisation that has legal personality under the laws of the country it is governed by. This makes companies in the Republic of Ireland, Jersey, Guernsey and the Isle of Man all overseas entities along with the rest of the world.

What is a beneficial owner?

A beneficial owner for the purposes of the Register of Overseas Entities is an individual, legal entity, trust, foundation, partnership or government with one or more of the following with regards to the overseas entity:

– more than 25% of the voting rights

– more than 25% of the shares

– the ability to appoint a majority of its directors

– significant influence or control of the overseas entity.

The above are the same criteria as the persons of significant control (PSC) regime, another register aimed at corporate transparency that was introduced in 2016.

Companies House cannot help an overseas entity to identify its beneficial owners. The overseas entity must employ its own means of doing so, which may include seeking independent advice.

Note that the Register of Overseas Entities records details of the beneficial owners of the overseas entity rather than focussing on those who hold title to the actual land or property in question. That is the point of the ROE: to identify those who benefit indirectly from property ownership in the UK and who therefore might, in rare cases, use it to launder money.

Companies House cannot help an overseas entity to identify its beneficial owners. The overseas entity must employ its own means of doing so, which may include seeking independent advice.

The above rules mean that in some cases an overseas entity can have multiple stakeholders yet no registrable beneficial owners. For example, if an overseas entity has five shareholders each with an equal share, then each holds only a 20% stake – below the registrable minimum of 25%. It therefore does not need to register any beneficial owners at all. This seems to represent an opportunity for those with ‘dirty money’ to continue to exploit the system by applying sharp practice in the management of members – but that is the law as it stands at the time of writing.

What is a relevant interest?

In England and Wales, an overseas entity has a relevant interest in a property if it holds:

- A freehold (ownership), or

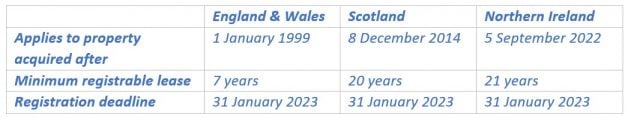

- A lease longer than 7 years on a property that was acquired after 1 January 1999 (more precisely, the application to register the overseas entity as owner or tenant was made on or after that date).

In Scotland, a relevant interest is ownership or a lease of more than 20 years where the acquisition occurred after 8 December 2014.

In Northern Ireland, a relevant interest is ownership or a lease of over 21 years where the acquisition occurred after 5 September 2022.

What information must be supplied when registering?

Before registering on the ROE, an overseas entity must go through verification checks conducted by a UK-regulated agent. The agent can be a financial institution, accountant or legal professional and must be supervised under the UK’s Money Laundering, Terrorist Financing and Transfer of Funds Regulations 2017. The agent will use an agent assurance code as part of the registration process to verify that the company is what it seems. Here is the current list of agents with an agent assurance code. More details are here: Agent assurance codes for registering an overseas entity.

Overseas entities must supply to Companies House:

- Basics such as name, office address and country of incorporation

- Type of organisation

- Details of the law that governs it

- Company number, if applicable, on the overseas public register, if such exists.

Details of the property must include:

- Deed or title number

- Date the land was acquired or disposed of

- Other details of the transaction, especially if other people or parties are involved.

The beneficial owners’ details must include:

- The basics such as name and contact details

- Nationality

- Date they became a beneficial owner of the overseas entity

- A service address

- Nature of their control over the entity (see What is a beneficial owner? above).

If no registrable beneficial owners can be identified, then the name(s) and details of the managing officer(s) must be given.

Agents must supply:

- Where applicable, their supervisory body

- Their AML (anti-money laundering) number

- Name of the person with overall responsibility for the verification checks.

For full technical details, it is best to refer to the current government guidance since the ROE is new and the details are likely to change over time. You can find it here: Register of Overseas Entities: guidance on registration and verification.

When must overseas entities register?

All overseas entities with a relevant interest in UK property must register on the ROE and name their registrable beneficial owners before 31 January 2023. This information must be updated annually with Companies House. At the time of writing the process for doing so is still under development. But regular confirmations of at least annual frequency are going to be a requirement.

A stated aim of the ROE is to maintain a ‘record of events’ that includes changes over time in the beneficial owners’ relationships with the overseas entity. This should be a dynamic record of the date they became registrable beneficial owners, the date they ceased to be such, and any changes of registrable beneficial owners or their details. This is preferable to just taking an annual ‘snapshot’, which would create a potential loophole.

This information must be updated annually with Companies House. At the time of writing the process for doing so is still under development.

Any updates to the information held on the ROE will have to be verified in the same way as the original registration details and a verification statement supplied to Companies House within 14 days of delivery of the information. Companies House will follow up with the overseas entity if it suspects there are issues with the updated information.

How to register

Companies House does not yet permit the use of filing software such as Inform Direct for registration on the ROE. Registration can currently only be carried out directly via the Companies House website. To access the service, you must create or sign into a Companies House account.

A list of ROE fees was published on 28 July 2022. It is subject to change as things progress. A fee is payable by credit or debit card upon application and will be refunded in full if the application is rejected. Currently this fee cannot be paid from a Companies House payment account. There are also fees for certified copies and for applying to make a relevant individual’s details unavailable for public inspection. There needs to be good reason for this, e.g. political sensitivity and/or personal safety.

On 10 August 2022 Companies House published a letter to overseas entities who own or lease property or land in the UK. Overseas entities who are known holders of UK property should be receiving this letter before 31 January 2023. Non-receipt of the letter is not an excuse not to register!

Government resources and guidance on the ROE

Letter to overseas entities who own UK property

Main registration page with instructions

Register of Overseas Entities: technical guidance on registration and verification

Agent assurance codes for registering an overseas entity

Information from the Land Registry about the Register of Overseas Entities

All companies are required to maintain up to date company records. Inform Direct is the perfect tool to help you easily keep everything up to date.